MicroStrategy has ramped up its Bitcoin buying spree, now holding well over 400,000 BTC. But with that much invested, concerns about the company’s financial health are starting to bubble up, especially from Ki Young Ju, CEO of CryptoQuant.

That would be the mother of all dips

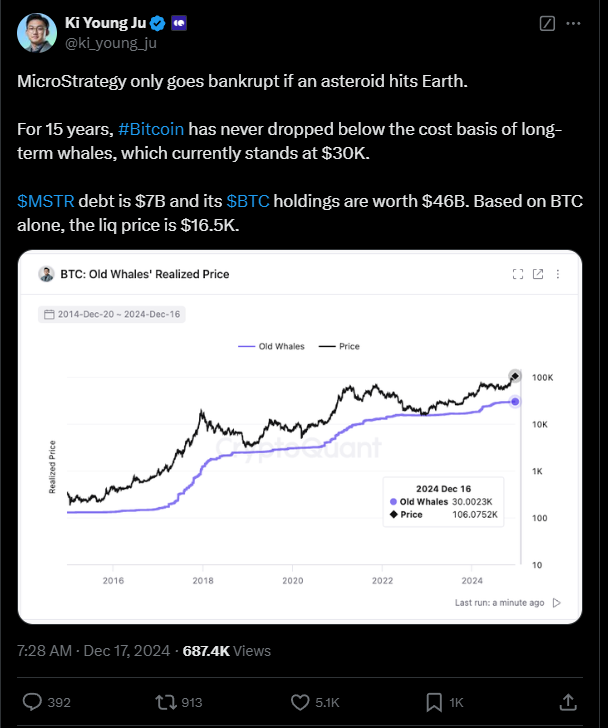

Ju warns that while bankruptcy isn’t out of the question for MicroStrategy, it would take something as unlikely as an asteroid hitting Earth to make it happen.

In a post on X Ju pointed out that Bitcoin has established a solid price floor, never dipping below the long-term cost basis for major holders, which currently sits at $30,000.

“MicroStrategy’s debt is $7 billion, while its Bitcoin holdings are valued at $46 billion. The liquidation price would be around $16,500, and considering the last cycle’s bottom was $16,000, predicting a drop to that level now seems as far-fetched as guessing Bitcoin would hit $3,000 when it was at $60,000.”

Uptrend

CryptoQuant also noted that Bitcoin grew to a new all-time high above $108,000 in the past days, fueled by about $151 million in short liquidations within a 12-hour window.

This spike also saw the Bitcoin-to-gold ratio reach an all-time high, reinforcing Bitcoin’s status as digital gold and highlighting its role as a preferred store of value compared to traditional gold.

Adding to the positive vibes is MicroStrategy’s inclusion in the Nasdaq 100, which has lifted market sentiment big time. Saylor hinted at more Bitcoin purchases ahead, even with prices are above $100,000.

CryptoQuant believes this Nasdaq listing could lead to passive inflows into MicroStrategy shares, giving the company even more capital for its Bitcoin acquisitions.

Business plan what works

Saylor announced on Monday that MicroStrategy has been on a buying streak for six weeks straight, and this latest round of purchases brings their total Bitcoin stash to 439,000 BTC, acquired for around $27.1 billion at an average price of $61,725 per coin.

He also revealed that their Bitcoin assets have seen impressive gains, up 46.4% quarter-to-date and 72.4% year-to-date.

Interestingly, CryptoQuant noted that this week’s central bank meetings seem secondary to the current market sentiment surrounding Bitcoin.

While it’s highly unlikely, an “extremely dovish stance” from the Federal Reserve and Chairman Jerome Powell could give BTC an extra push upwards.