The U.S. government’s decision to transfer $1.9 billion worth of Bitcoin to Coinbase has raised concerns among experts.

Major Jason Lowery from the U.S. Space Force didn’t hold back, stating, that there’s no price at which it makes sense for the U.S. to sell any Bitcoin it controls.

Critique

The author of the ’Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin’, expressed his concerns, calling the move a huge strategic mistake.

He suggested that the government seems clueless about the true value of what it owns.

“They have no idea what they own, and it shows.”

He even referenced Executive Order 6102 from 1933, which prohibited gold hoarding, hinting that a similar situation could arise if the government regrets selling its Bitcoin.

Why are they selling?

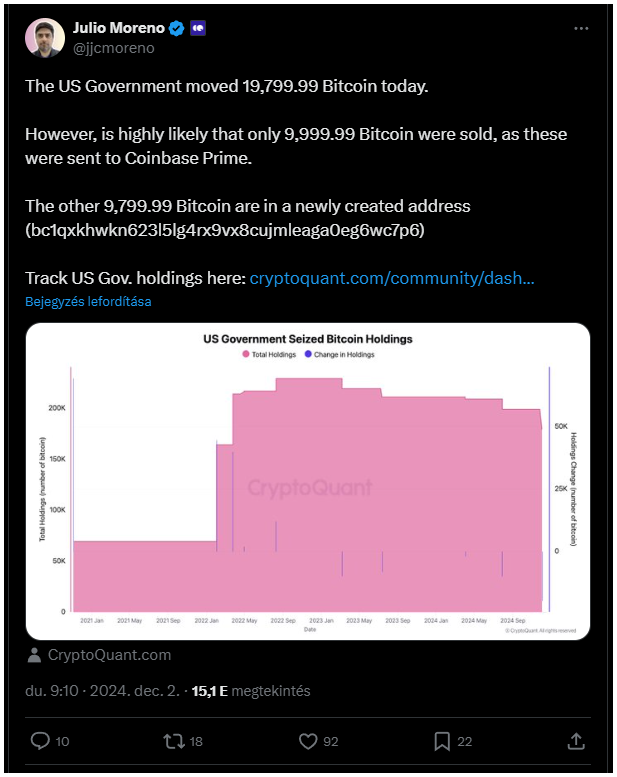

The government moved about 19,800 BTC, valued at around $1.9 billion to a Coinbase Prime deposit address, and this has sparked speculation about whether these transfers are actual sales or just custody actions.

Coinbase CEO Brian Armstrong echoed Lowery’s sentiments, suggesting that selling could be a poor decision.

Crypto educator Toby Cunningham chimed in with some humor, saying the market will buy.

“If they are dumb enough to sell (which we all know governments can be), that supply will get eaten up instantly.”

Another observer quipped that President Biden might do as much damage as he can before leaving office.

Selling? Consolidation? Custody

So far this year, the U.S. government has transferred a total of 25,999 BTC worth about $2.49 billion to Coinbase, but analytics platform Spot On Chain suggests these might not be sales but rather actions related to custody or wallet consolidation.

Tether strategy adviser Gabor Gurbacs pointed out that we don’t have all the information yet and emphasized that there’s no guarantee these assets will be sold.

Julio Moreno from CryptoQuant noted that it’s likely only 10,000 BTC were sold in these recent transfers, with the rest going to a new address.

As for the market reaction? Bitcoin prices dipped nearly 3%, falling to around $94,500 at the time of the transfer but later rebounded to about $96,000.

But 3% is nothing, Bitcoin market already endured double digits daily dips multiple times in its history, and still, tick-tock next block.