This week has been a wild ride for Ethereum, which climbed to a five-month high of $3,687.

Then the price has cooled off a bit and is now sitting around $3,620 i the time of writing.

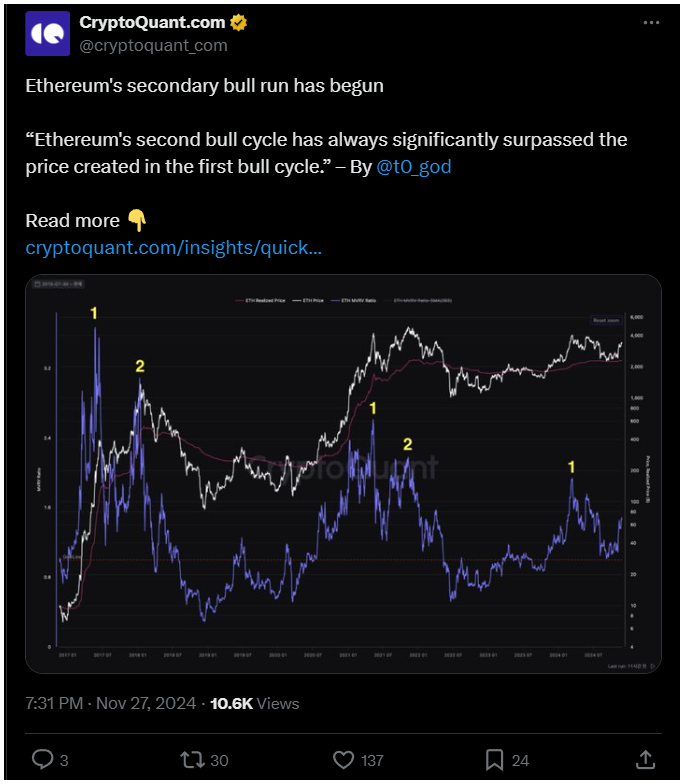

CryptoQuant shared that this uptick signals that Ethereum is entering the second phase of its bull run.

Chasing ATH

Ethereum’s all-time high stands at $4,891.70, meaning it needs to climb at least 26% from its current price to break that record.

But here’s the kicker, Ethereum hasn’t even tested the $4,00 resistance level since March of this year.

Back then, it briefly crossed that threshold when excitement around Bitcoin ETF approvals sparked the first wave of BTC’s bull cycle, and if Ethereum can push past that psychological barrier of $4,000, there’s a real chance it could reclaim its ATH. But now it seems a little unlikely.

The competition heats up

Of course, Ethereum isn’t without its challengers, in fact, it faces stiff competition from other blockchain protocols and layer-2 scaling solutions, so Ethereum needs to step up its game to stay relevant.

Co-founder Vitalik Buterin has laid out an ambitious roadmap for scaling the Ethereum blockchain.

This includes updates dubbed The Surge, The Scourge, The Verge, and The Purge. Ffs. Who made up these terms?

Anyway, to make it easier for people to become validators by allowing them to host nodes on their mobile phones and lowering the requirements needed to participate.

What’s next for ETH? Moon, or goblin town?

These upgrades want to speed up transactions and boost the overall user experience on the Ethereum network, so if successful, they could lead to greater adoption and help ETH maintain its growth trajectory.

As Ethereum continues its quest for higher prices and improved functionality, all eyes are on how it will compete in an increasingly crowded market. Will it reclaim its former glory? Only time will tell!