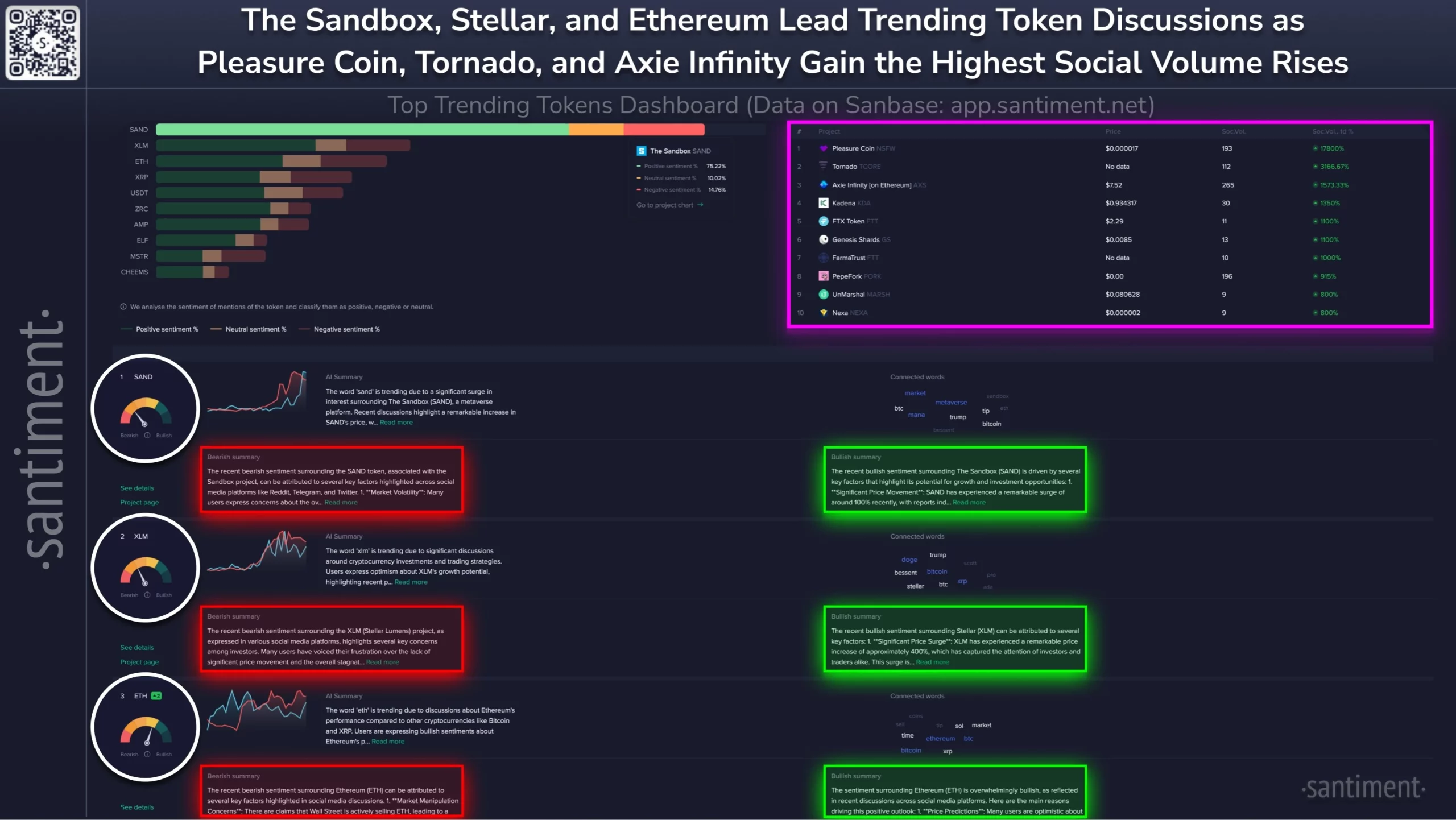

Data from Santiment reveals that cryptocurrencies like Sand, XLM, and Ether are stealing the spotlight in recent discussions. What Bitcoin dip?

Strong resistance

Bitcoin fell below $93,000 on November 25, but that hasn’t dampened spirits in the alt arena.

In a post on X, Santiment noted that traders are still riding high on various alts and chatting about exciting opportunities that might be flying under the radar.

Leading the charge is SAND, the token for the metaverse platform Sandbox. Santiment reports that SAND is gaining traction thanks to a resurgence in metaverse investments, with investors feeling more confident about SAND and its peers.

Santiment also pointed out that there’s a bullish vibe surrounding metaverse tokens, despite previous downturns.

“Speculation about why this trend is happening and what it means for these cryptocurrencies is also buzzing.”

Next up is XLM, which has caught the eye of Korean investors following a recent political event. This interest has been linked to price surges and lively discussions on social media. And let’s not forget Ethereum!

Santiment highlights that traders are comparing Ethereum’s performance to other cryptocurrencies, with many expressing optimism about its potential to outshine other major coins, especially given favorable market conditions.

Social media hype

Santiment uses a social tracker to sift through crypto-related conversations on platforms like X and Telegram. They look for the top ten words that have seen a spike in mentions over the past two weeks.

Their findings indicate that discussions around Ethereum emphasize its historical performance and ecosystem value, showing a keen interest in its future prospects.

Interestingly, some lesser-known coins like Pleasure Token, Tornado, and Axie Infinity have also seen visible increases in social media chatter lately.

Liquidations hit hard

Despite all this altcoin excitement, the whole market faced some serious turbulence with mass liquidations over the last 24 hours.

More than $518.8 million in crypto positions were wiped out, with long positions accounting for $389.3 million and short positions for $129 million. Most of these liquidated positions were tied to alts, not Bitcoin.

One trader on X, known as Moustache, speculated that even with this drop, altcoins are just warming up here, suggesting that the real party is still ahead.

Another trader, Eugene Ng Ah Sio, shared their cautious approach. They added that this has been one of the most challenging altcoin seasons they’ve experienced.

“I’ll be watching and waiting for now because the market is becoming too hard to predict.”

Have you read it yet? Phantom Wallet’s newest chain is the Base Network

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.