Ethereum (ETH) has been on a bit of a rollercoaster lately, with some notable gains in the past weeks.

But retail investors aren’t cashing in just yet, they’re holding onto their coins because they believe ETH is still undervalued.

The Trump trade effect

In the past weeks various digital assets, including Ethereum, have seen their prices rise, and while many investors have taken profits from other coins, ETH holders are sticking to their guns.

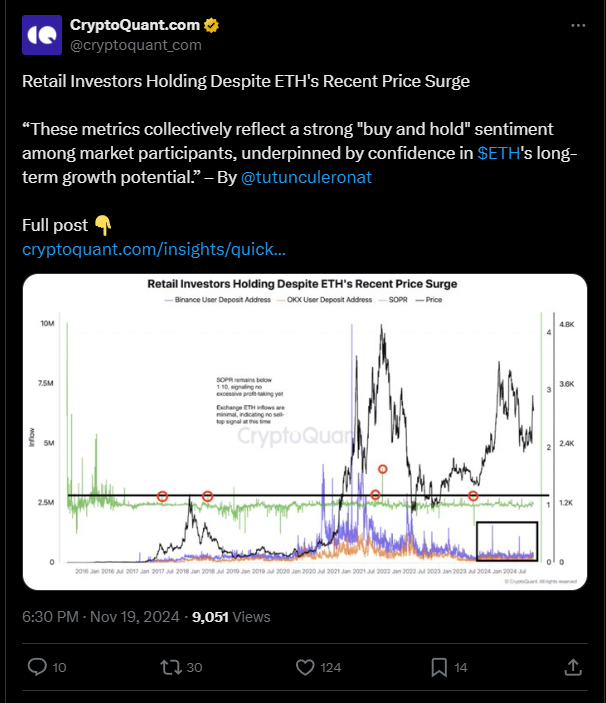

A CryptoQuant analyst, Onatt shared that it seems that retail investors are more focused on long-term potential than immediate gains.

At the moment, Ether is trading at around $3,200, down 2.7% over the last week. On the other hand, it has rallied by 17.76% this month and is up 38% year-to-date. Despite these ups and downs, investors are staying put.

How do we know they’re not selling? Well, there have been low inflows to deposit addresses on major exchanges like Binance and OKX.

Typically, higher inflows indicate that traders are moving their assets to cash out and take profits. But that’s not happening with ETH right now.

Additionally, the Spent Output Profit Ratio for Ethereum is still below 1.10. This means most transactions are occurring at or near breakeven levels, with investors barely realizing any profits.

Buy and hold

According to Onatt, these trends show a solid buy and hold mentality among ETH investors who are confident about Ethereum’s long-term growth potential.

There are indeed some volatility in the market, but this reluctance to sell suggests that many believe Ethereum’s current price is still attractive and poised for further gains.

Onatt believes that if ETH can stay above $2,800, it might just hit $4,000 in the short term, but not everyone is convinced.

Ki Young Ju, founder and CEO of CryptoQuant, tweeted that Ethereum’s performance will largely depend on how much revenue Web3 applications can generate through stablecoins.

There is no second best

Ju pointed out that Ethereum is currently lagging behind Bitcoin. He noted that the ETH-BTC Net Unrealized Profit/Loss indicator has dropped to a four-year low.

While he acknowledges Ethereum’s long-term potential and sees opportunities for ETH believers, he feels that its underperformance issue isn’t going away anytime soon due to the ecosystem being heavily leveraged.

“Over a one-year timeframe, I find it less appealing than Bitcoin, but it could gain traction as regulations start to take shape.”