Solana is climbing over 30% to surpass the $201 resistance level that had held for eight long months.

Known as an Ethereum killer for its impressive scalability, Solana now joined the exclusive club of cryptocurrencies with a market cap exceeding $100 billion.

Huge milestone for Solana

Before you pop the champagne, you have to know there are some warning signs that could make it tricky to maintain these gains in the days ahead.

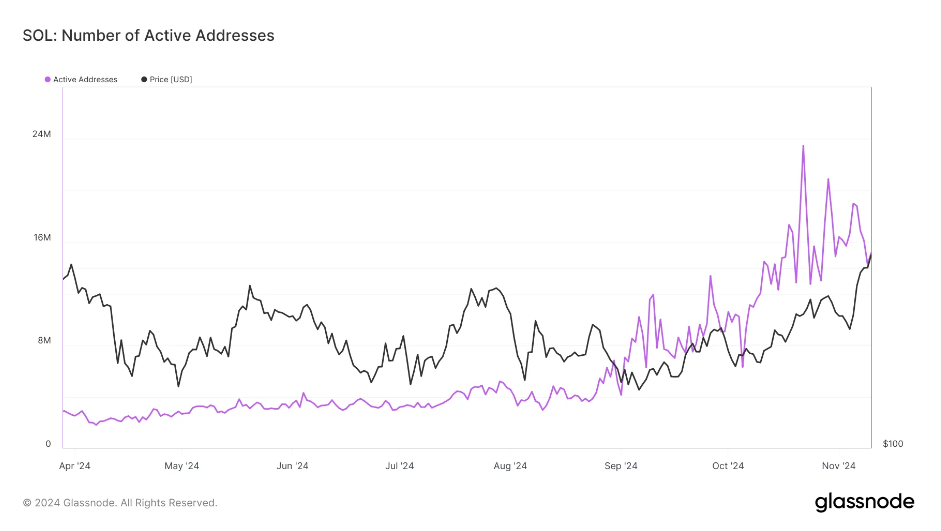

Despite the price rally, there’s a bit of a red flag, for example active addresses on the Solana network are starting to decline.

This drop has created what’s known as a Daily Active Addresses Divergence, which hints at potential selling pressure.

When prices rise but fewer people are using the network, it often signals that interest is waning, which can lead to a dip in momentum. And in prices.

This divergence could mean caution is in order. The sell signal from this indicator reflects uncertainty among traders and may limit further price increases.

If this trend continues, we might see a wave of profit-taking as investors rush to cash in on their gains, which could impact SOL’s price stability.

Solana is overbought?

Solana’s momentum is showing signs of overextension. The RSI currently places SOL in the overbought zone.

Historically, this situation often leads to short-term corrections when prices become too inflated.

If the RSI stays high, it could suggest a potential reversal and a temporary price drop. This overbought status also indicates that Solana’s upward momentum might struggle if investor hype starts to cool off.

The risk of a reversal is heightened since past instances of high RSI readings have typically been followed by profit-taking.

What’s next for SOL?

After its rally, Solana hit a three-year high of $215 but is currently trading around $205.

With declining address activity and an overbought RSI, SOL is approaching an important support level at $201. If it can’t hold above this, we might see further declines.

If investors start booking profits, Solana could slide down toward $186, another key support level for the alt.

Staying above $186 is pretty vital for maintaining its upward trend, falling below that could signal deeper corrections.

On the other hand, if Solana can bounce back from the $201 support level, it may aim to break through the next resistance at $221, and this would likely push Solana’s market cap back above $100 billion again and reignite bullish momentum.

Have you read it yet? El Salvador’s Bitcoin stash is in $111 million profit

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.