With Donald Trump’s recent victory in the U.S. presidential election, the crypto industry is buzzing with optimism, especially regarding Ripple’s ongoing legal battle with the SEC.

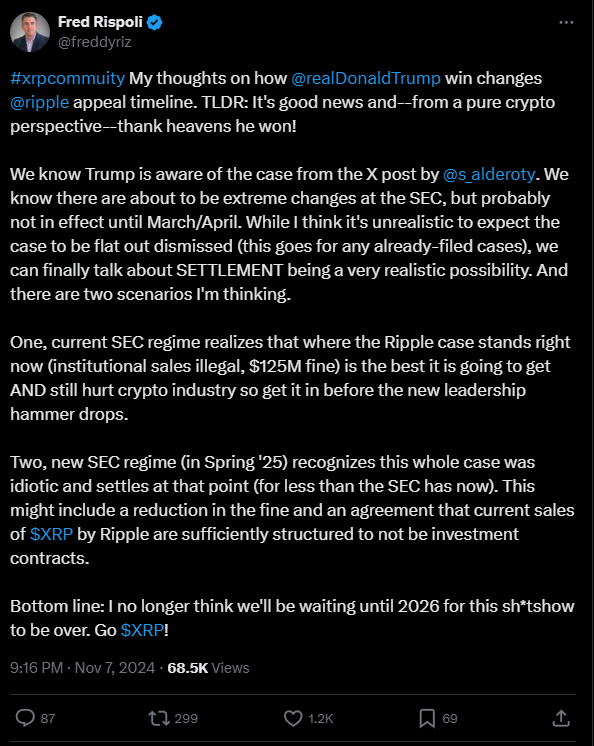

Crypto lawyer Fred Rispoli believes Trump’s win could change the game for Ripple, potentially leading to a quicker resolution of their issues with the commission.

A new hope for Ripple

The heavy investment from the crypto sector in the 2024 election seems to be paying off, as it could signal the end of Gary Gensler’s rule as SEC Chair.

Rispoli suggests that with Trump taking office, we might see some changes at the SEC that could expedite Ripple’s case.

In a post on X, Rispoli laid out two possible scenarios, because either the SEC rushes to finalize a deal to secure a partial win or new leadership takes over, which could lead to a settlement for a lower amount, perhaps even reducing Ripple’s $125 million fine.

He believes that waiting until 2026 for a resolution now seems unlikely, and there’s a chance the XRP community could see this sh*tshow come to an end by spring 2025.

Ripple CEO Brad Garlinghouse also chimed in on what a Trump administration might mean for crypto, and he praised the XRP community for their patience and resilience during this prolonged legal battle.

Garlinghouse reflected on the six-year struggle since the SEC first stepped in, criticizing the agency’s “unnatural and manipulative” approach to regulating crypto.

I’ve shared some thoughts on what the Trump administration could mean for crypto and wanted to also recognize the XRP family’s patience and unwavering support.

A lot has happened since XRP was the 2nd most valuable digital asset. It’s been – at times – a frustrating journey.~6…

— Brad Garlinghouse (@bgarlinghouse) November 7, 2024

He remains hopeful that the new administration will provide some relief for the industry and create more space for XRP to thrive.

XRP’s price struggles for way too long

Currently, XRP is down over 10% year-to-date, while other major cryptocurrencies like Bitcoin and Solana have seen gains of 79% and 96%, respectively.

As of now, XRP is trading at around $0.55, which is 85% drop from its all-time high of $3.84 reached on January 4, 2018.

If the SEC decides to wrap up their current deal soon, XRP might still face some penalties but could avoid lengthy litigation.

This outcome would finally pave the way for greater regulatory clarity in the crypto space.

The SEC’s crackdown under Gensler looks like an agenda

The crypto community is celebrating what could be a major victory against Gary Gensler’s aggressive regime at the SEC.

Gensler has led a fierce crackdown on crypto companies, ramping up enforcement actions with 46 crypto-related cases filed last year, and this is a 50% increase from the year before.

He has targeted major players like Coinbase and Binance, achieving significant wins under outdated securities laws.

Have you read it yet? BlackRock Bitcoin ETF hits record with $4.1 billion daily trading volume

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.