SUI Network is making a big surprise in the crypto industry by surpassing Solana in DEX trading volume, with $7.5 billion in transactions.

SUI’s growth looks crazy

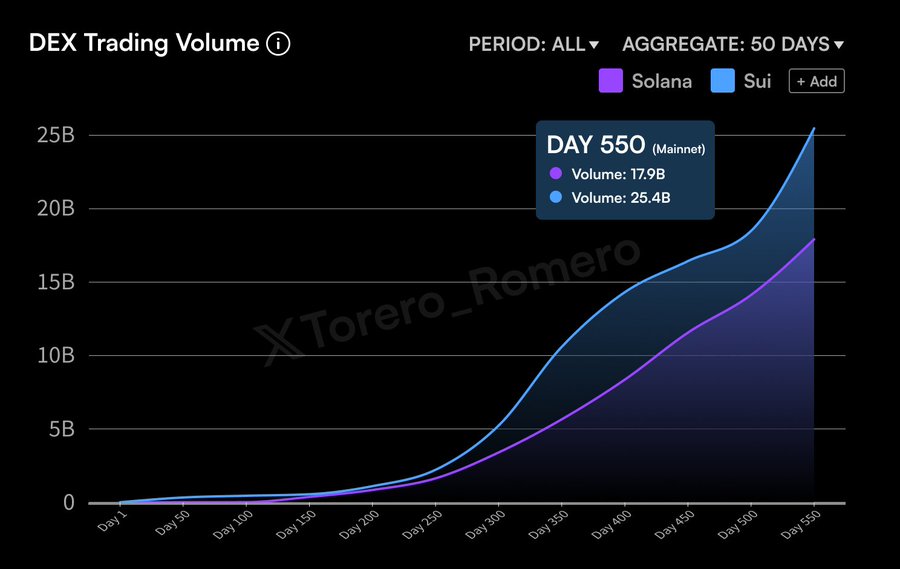

When we look at DEX trading volumes, SUI is clearly on a roll. Over a 550-day period, with data collected every 50 days, SUI’s trading volume hit $25.4 billion, while Solana managed $17.9 billion.

Both networks have seen increased user activity, but SUI’s growth really took off around day 300, meaning it might be gaining traction and could outpace Solana in trading activity.

What’s driving this surge? A big part of it is SUI’s recent advancements. They launched the Mysticeti consensus engine, which significantly boosts transaction capacity, and they’ve teamed up with Google Cloud for more scalable and secure application deployment. Talk about leveling up!

Price and DEX growth correlate?

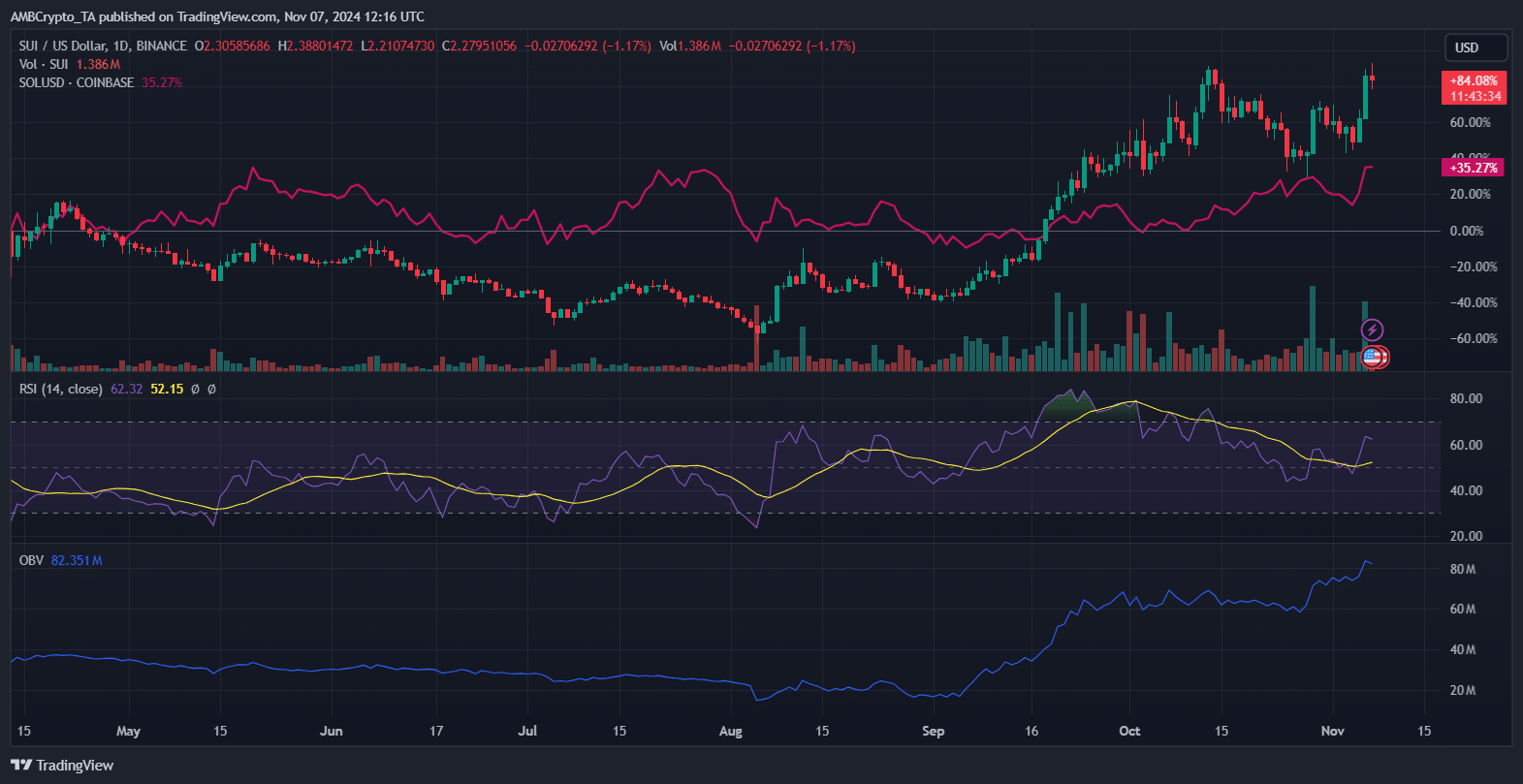

SUI’s price performance mirrors its DEX success. Currently trading around $2.30, SUI has seen a gain of 82.80% over the past few months.

In comparison, Solana’s price grew by 35.64% during the same timeframe, showing that SUI is capturing more investor interest and market momentum.

Moreover, SUI’s trading volume also spiked recently, hinting at increased activity and buying interest among traders.

Don’t stop now

Looking at some technical indicators, SUI’s RSI is currently at 61.61, suggesting strong buying momentum but still leaving room for further upside before hitting the overbought territory.

The On-Balance Volume also shows a steady upside trend, a solid accumulation by investors.

This positive price momentum aligns pretty well with SUI’s growing DEX volume, signaling increasing utility and investor confidence, and this two typically lead to price appreciation.

Overall, SUI’s rally driven by its dominance in DEX trading suggests a quite bright future with more sweet gains.

Have you read it yet? Post-Election Rally Sparks Surge—Is This Just the Beginning for Ethereum (ETH), Solana (SOL), and Monero (XMR)?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.