While the crypto market is enjoying a nice surge, XRP seems to be sitting on the sidelines.

Bitcoin pushing toward new all-time highs and dragging many altcoins along for the ride, but XRP has been stuck in neutral.

In fact, over the past week, it’s seen a slight dip in value, adding to a lackluster performance over the last 24 hours.

XRP’s performance I mean what performance?

As most cryptocurrencies bask in the glow of a bullish market, XRP is one of the few major players that isn’t joining the party.

Right now, XRP is showing a modest decline in both its daily and weekly performance metrics, which is puzzling for investors who are excited about the overall market enthusiasm.

XRP’s struggles put it in the same boat as Toncoin, which also hasn’t gained any traction during this rally.

Usually, when the market heats up, altcoins benefit from a cascading effect. But this time around, XRP has decoupled from that trend.

Shifting funding rates signal changing sentiment

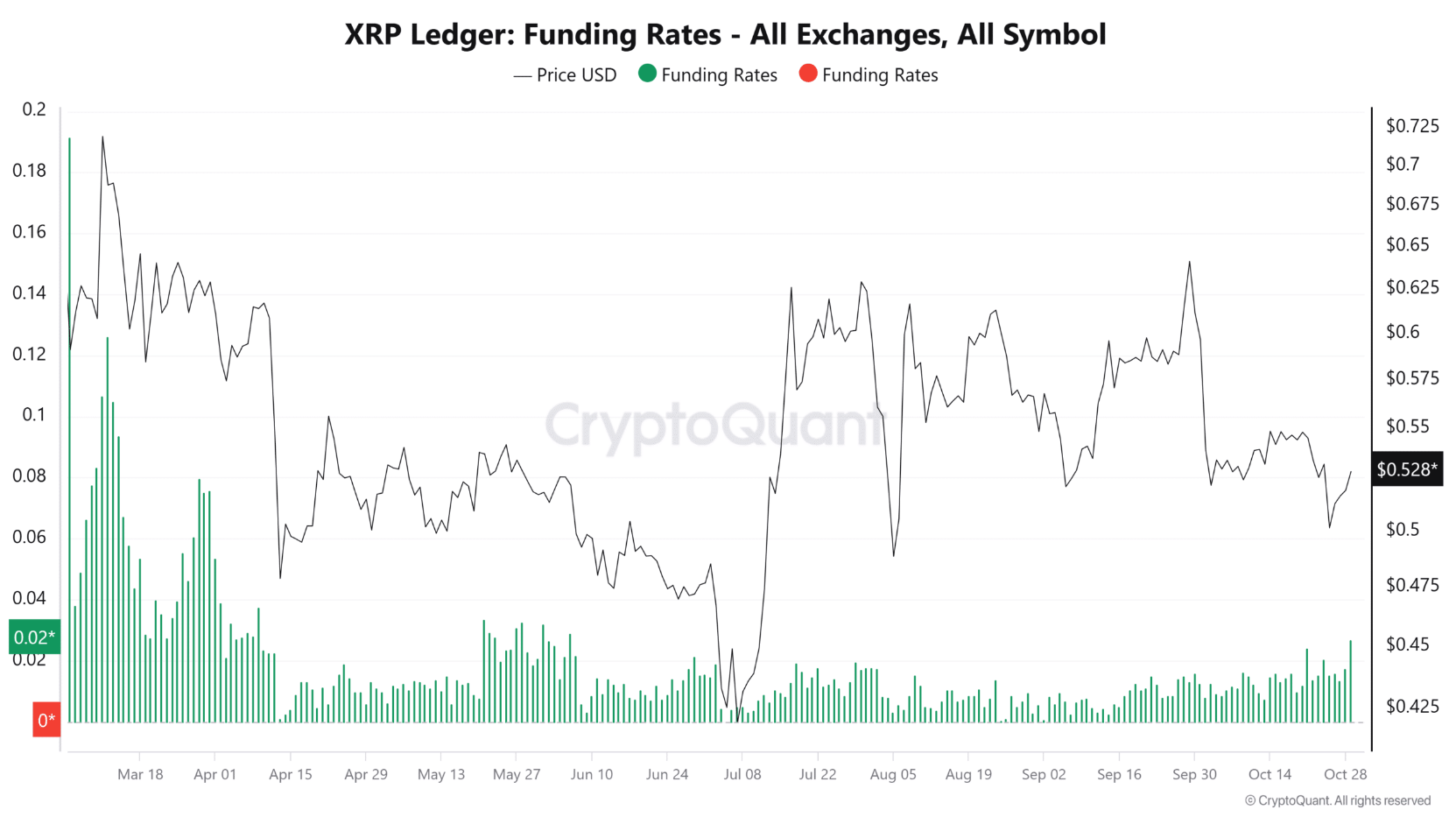

Looking at funding rates for XRP across various exchanges gives us some clues about what traders are thinking.

Now it seems that these rates have shifted, suggesting that traders might be adjusting their positions based on a changing market outlook.

A high positive funding rate usually indicates bullish sentiment, as traders are willing to pay a premium to hold long positions.

On the other hand, if funding rates drop or turn negative, it often signals waning enthusiasm or a shift toward bearish sentiment.

In XRP’s case, funding rates have moved toward neutral or slightly negative territory. This suggests that while other assets are experiencing optimism, XRP isn’t feeling the same love. It’s like being at a party where everyone’s dancing except for you.

Support level, where art thou?

Diving into XRP’s price chart reveals that it’s been consolidating around the $0.52 mark.

Unfortunately, this is below both the 50-day and 200-day moving averages of about $0.56.

In simple terms, there are strong resistance levels holding XRP back as bearish sentiment takes hold.

The RSI is hovering around 44, indicating that XRP isn’t in oversold or overbought territory yet, but it’s trending closer to being oversold, which could signal some weakness.

This level might act as a support zone where buyers could step in if they think the asset is undervalued.

Still, without strong momentum on the RSI, buyers seem hesitant—likely waiting for stronger market catalysts before making their move.

Have you read it yet? MicroStrategy’s $42 billion Bitcoin plan

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.