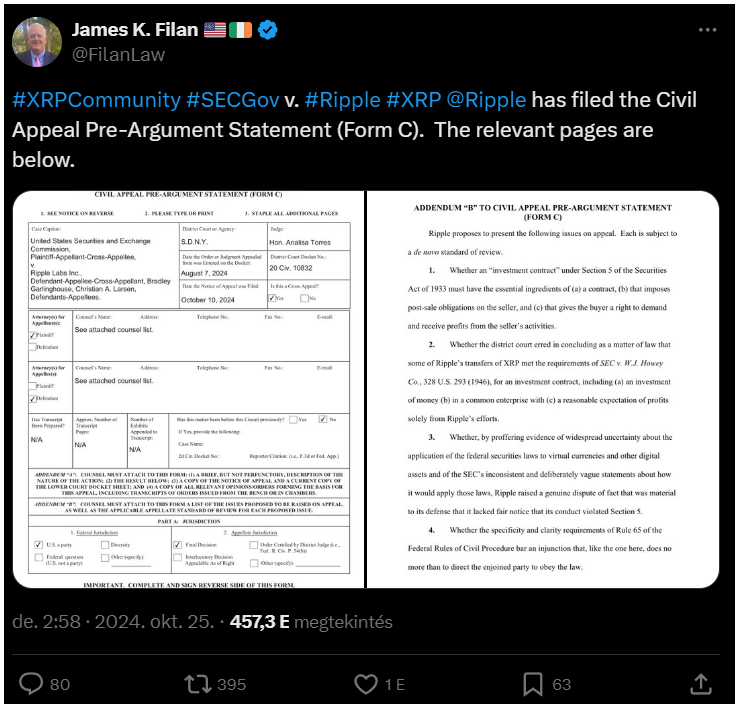

Ripple Labs is stepping up its legal game against the U.S. SEC with a new filing known as Form C, or the Civil Appeal Pre-Argument Statement.

This comes right after the SEC launched a last-minute appeal against parts of a 2023 ruling that found Ripple’s programmatic sales of its XRP token to retail investors didn’t violate U.S. securities laws.

The four horsemen

Ripple has laid out four main questions for the Second Circuit Court of Appeal to consider.

The first question tackles whether an investment contract under the Securities Act of 1933 requires a formal agreement, obligations after a sale, and the right for buyers to share in profits.

This could really change how we understand digital asset transactions, and also, how the litigation will going.

Next up, Ripple is challenging the lower court’s decision that its XRP transfers met the criteria set by the famous SEC vs. W.J. Howey Co. case, which established the Howey Test for investment contracts.

Ripple argues that its transactions don’t represent an investment of money in a common enterprise where profits are expected solely from Ripple’s efforts.

Obey the law, but what law?

The third point revolves around fair notice. Ripple claims it provided enough information to potential XRP buyers about the uncertainty surrounding cryptocurrency regulations.

This is a pretty big deal because it suggests that the SEC and other agencies didn’t give clear guidance on what was legal.

Finally, Ripple contests the clarity needed for issuing injunctions under federal rules.

They argue that the injunction given by Judge Analisa Torres, which included a $125 million fine, was too vague and just told them to obey the law without specifics.

After filing, Ripple’s Chief Legal Officer Stuart Alderoty shared that this case isn’t about determining whether XRP is a security overall.

He pointed out that XRP currently enjoys a non-security status, which wasn’t challenged by the SEC in their newest appeal.

Next round

This focus allows Ripple to hone in on specific legal issues rather than getting bogged down in broader regulatory debates.

With both sides having submitted their briefs, experts say it’s now up to the Second Circuit to issue a scheduling order to move things along.

Alderoty mentioned that the court will only consider existing records, meaning no new evidence will be introduced at this stage.

He believes this could help speed things up and minimize disruptions as they await a final judgment.

So Ripple is pushing back against the SEC with some hot legal questions on the table, and it looks like this courtroom drama is far from over!

Have you read it yet? South Korea wants to monitor cross-border crypto activity

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.