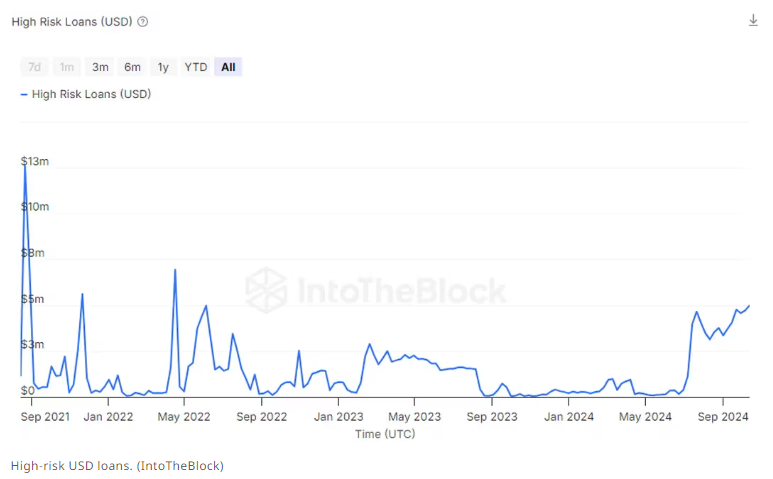

The amount of crypto-collateralized loans that are pretty close to liquidation surged to a two-year high, raising serious concerns about potential market volatility.

IntoTheBlock shared that as of Wednesday, the total for these high-risk loans, defined as those within 5% of their liquidation price, reached $55 million.

High-risk loans in crypto, it’s that bad?

The decentralized lending market is experiencing nice growth, but this increase in high-risk loans could lead to quite serious issues.

Traders often secure loans from decentralized platforms by using digital assets as collateral.

If the value of that collateral drops too much, the platform will liquidate the loan by selling off the collateral to cover the debt.

A loan that is within 5% of its liquidation price means that if the collateral’s value falls by just 5%, it will no longer be enough to cover the loan, leading to liquidation.

Chain reaction

This rise in risky loans is important because it can trigger a chain reaction known as a liquidation cascade.

In this scenario, one liquidation can lead to another, and liquidation here means market selling, no matter the price. This can quickly driving down crypto prices.

This drop can cause even more liquidations and increase market instability.

IntoTheBlock’s experts explained that large liquidations can impact the collateral value, putting more loans at risk of liquidation and creating a downward price spiral.

Rapid declines in the market can leave borrowers with insufficient collateral to cover their loans, resulting in losses for lenders.

Market liquidity

This kind of bad debt could harm market liquidity too, making it harder to execute large trades at stable prices.

Bad debt can keep lenders from adding new liquidity to prevent potential losses.

This situation suggests that if high-risk loans continue to grow, it could create a really challenging environment for both traders and lenders in the crypto market.