Pepe has seen a lot of ups and downs in the last 30 days, and the question now is whether this memecoin can bounce back and reach its three-month high.

Price performance

In the past week, Pepe faced a quite sharp drop, falling by 3.47%. Before this, it had been on a positive trend, rising by 37.43% over the month.

After hitting a price of $0.0000119, PEPE struggled to keep its upward momentum, and now it’s trading at $0.000009705, which is a 2.21% increase over the last day.

During the same period, its market cap grew by 1.90%, reaching $4.09 billion.

The overall gains bring some optimism for PEPE, suggesting that the drop could just be a temporary setback before another potential rise.

Market trends

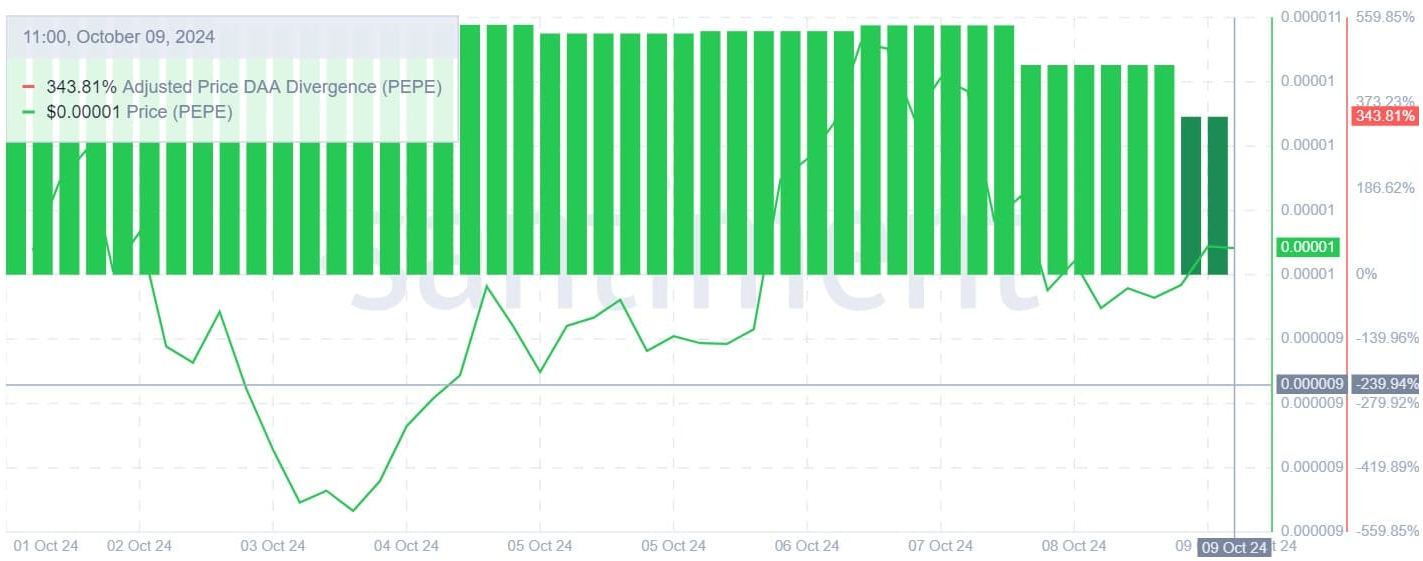

PEPE is looks like it’s testing a key resistance level at $0.00001. The memecoin already faced several rejections at this price point, but current market conditions might lead to a price increase soon.

The adjusted Daily Active Addresses divergence remained positive over the past week, so the demand is increasing and the market could be ready to reverse its downtrend.

Investors are here, and it seems they’re buying

A shift upward seems likely since PEPE is currently undervalued and prices haven’t yet aligned with improving fundamentals.

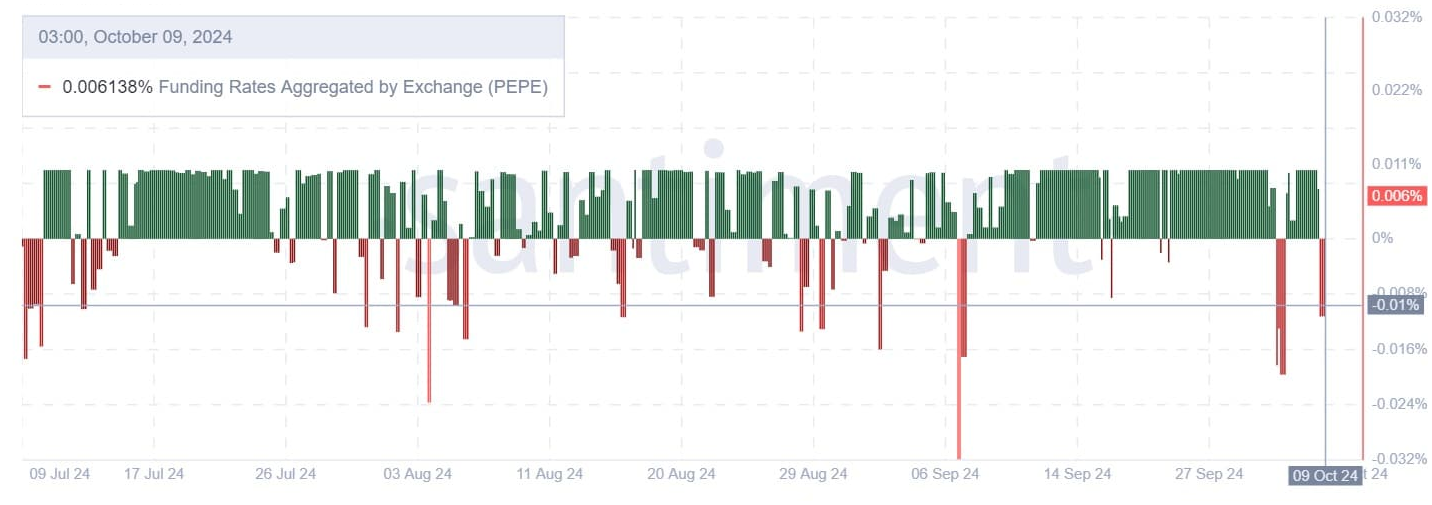

On the other hand, the Funding Rates Aggregated by Exchange turned positive at 0.006% after being negative just a day prior. Everything is there for a nice run.

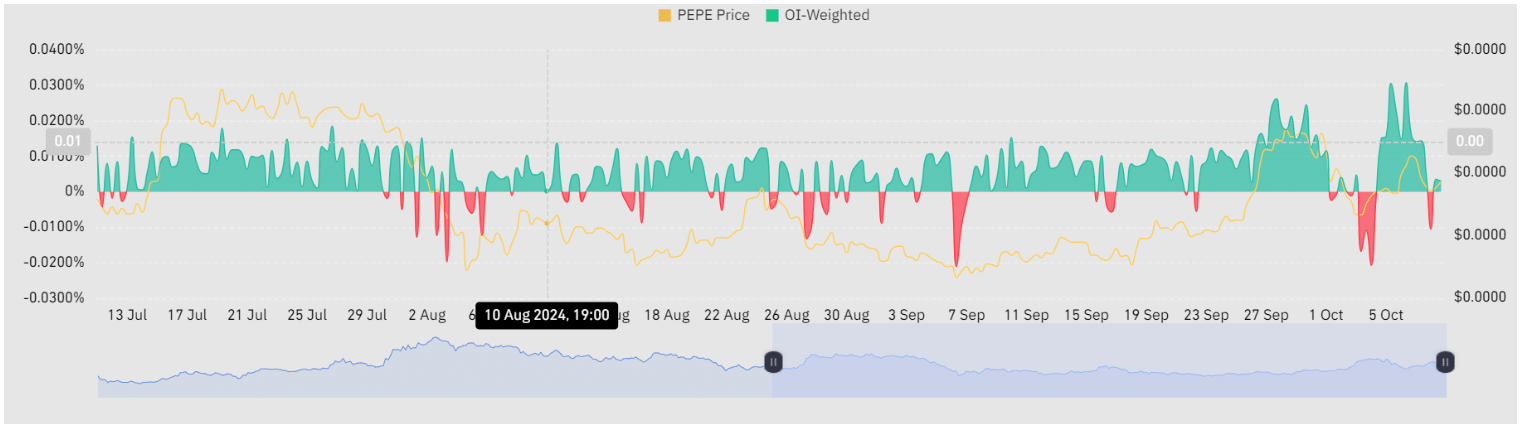

This change in sentiment is further supported by the Open Interest Weighted Funding Rate, showing that investor confidence in the memecoin’s future is growing.

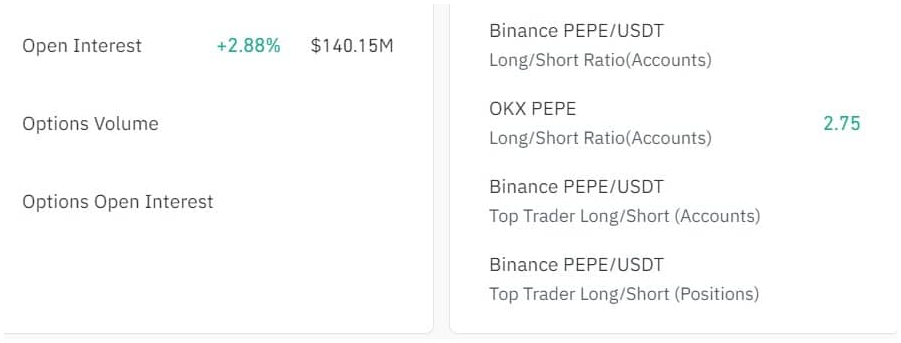

Coinglass data also reveals that Open Interest increased by 2.88% to $140.15 million in the last 24 hours, signaling that investors are opening new positions in anticipation of further gains.