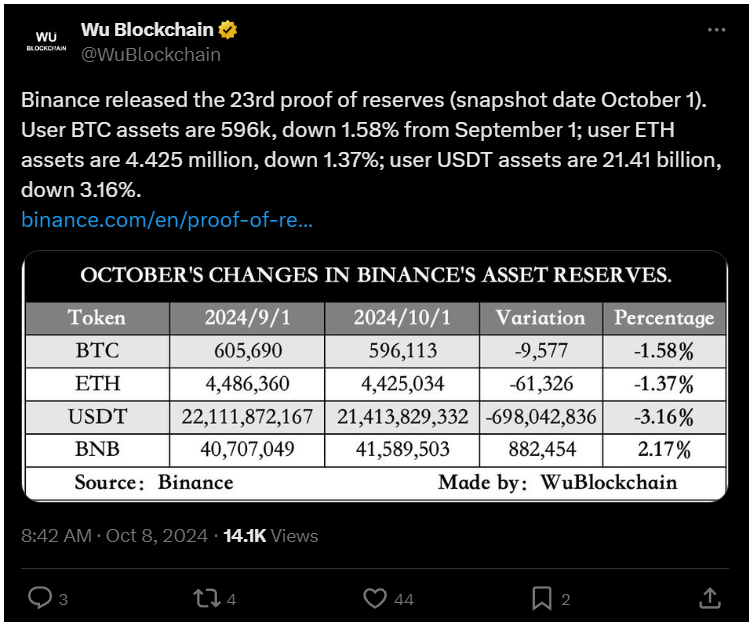

Binance released its latest proof of reserves for October, showing a decline in holdings for Bitcoin, Ethereum, and Tether, while its BNB reserves increased. BTC dropped by 1.58%, ETH by 1.37%, and USDT by 3.16%.

Changes in crypto holdings at Binance, business as usual?

In its 23rd proof of reserves snapshot, Binance reported that user holdings of major cryptocurrencies fell big between September and October 2024.

The reserves for BTC decreased by 9,577 coins, bringing the total down to 596,000. Similarly, ETH holdings were reduced by over 61,000 tokens, and USDT saw a drop of $698 million.

On the other hand, BNB holdings grew by 882,454 tokens, reflecting a nice 2.17% increase during this period.

Implications for the crypto market

This shift in assets could means that Binance is actively managing its portfolio.

The decline in BTC, ETH, and USDT suggests that users may be reallocating their assets or hopefully withdrawing funds during this quite volatile time. After all, not your keys, not your coins, right?

These changes are important as they reveal how Binance is adapting to the current state of the crypto market.

The drop in major cryptocurrencies could signal trends among traders and investors who might be looking for safer options or totally different investment strategies.

Stormy waters

One can speculate that as the crypto market continues to fluctuate, Binance’s ability to manage its assets effectively will be important for maintaining user trust and confidence in the exchange.

Funds have to be safu, as they say. The growth of BNB holdings could also show a shift in user preference towards Binance’s own token as they navigate the markets.

Have you read it yet? In this year, 87% of new tokens born on Solana

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.