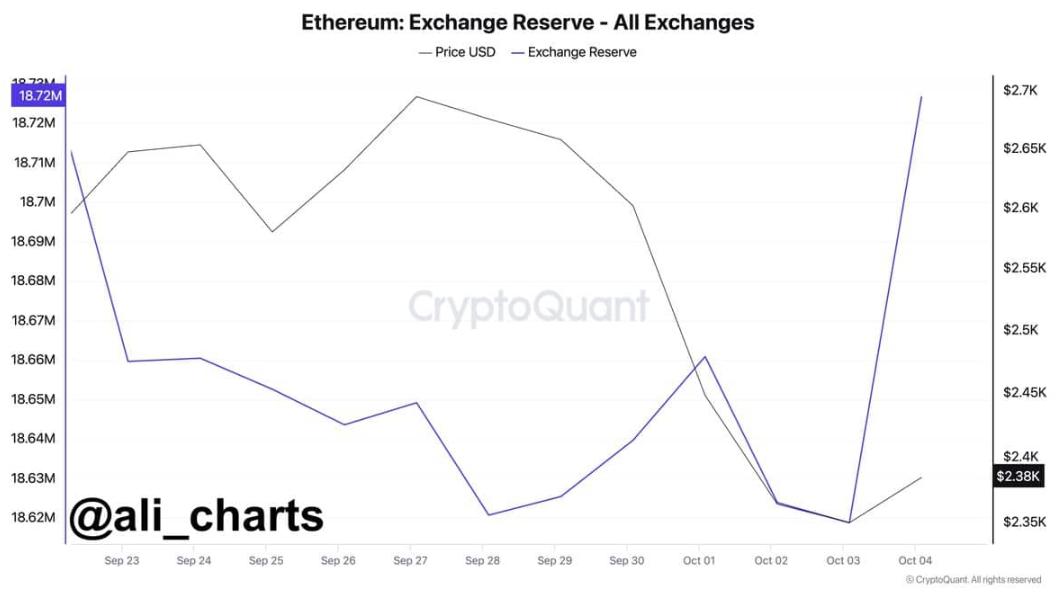

Ethereum is experiencing increased selling pressure. This trend is highlighted again by a big movement of ETH to exchanges, with over 108,000 ETH, priced at approximately $259.2 million, transferred within just 24 hours.

Selling pressure is always out there

This large influx of ETH to exchanges often suggests a potential drop in its price, because when supply increases while demand remains the same, it typically leads to lower prices.

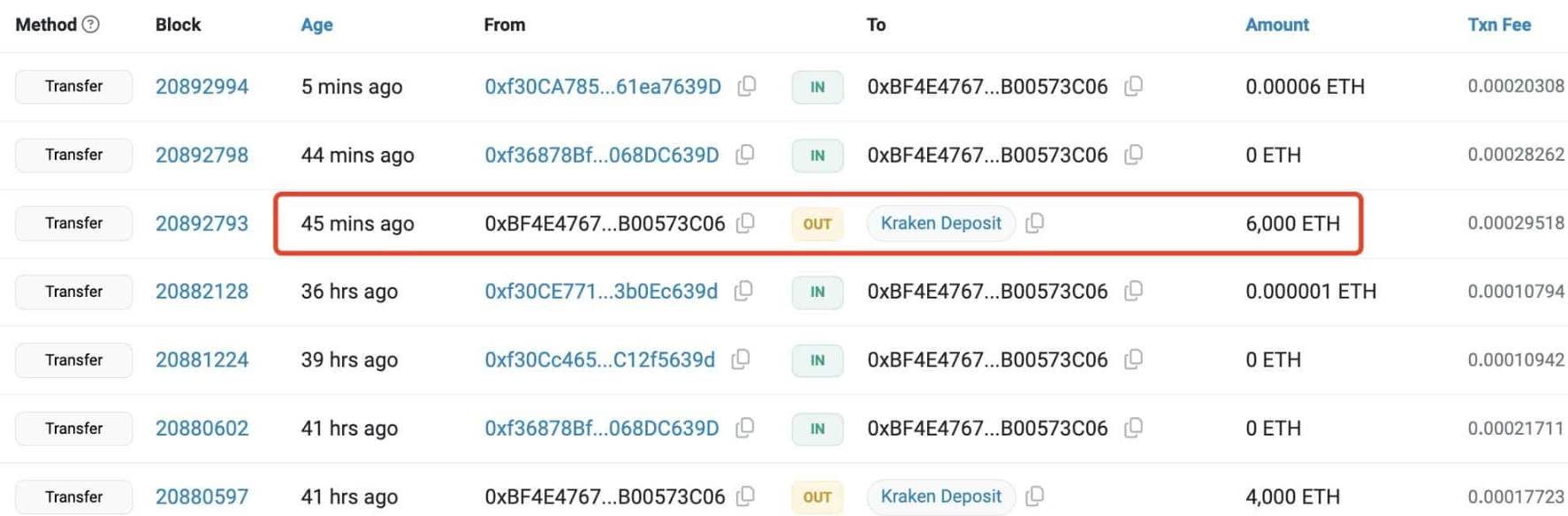

Now an individual who participated in an Ethereum ICO has been consistently selling their ETH holdings.

They sold 6,000 ETH worth about $14.11 million, bringing their total sales since September 22, 2024, to 40,000 ETH at an average price of $2,525.

Despite these sales, they still hold 99,500 ETH valued at around $238 million, meaning that more selling could be on the horizon.

Ethereum’s underperformance

Ethereum has also been lagging behind other riskier assets like Bitcoin and the S&P 500.

While Bitcoin has seen a slight decrease of 0.32% and the S&P 500 has risen by 3.63%, ETH has dropped double digits, by 26% over the past three months.

Also, total fees on the Ethereum network have fallen by 43.9%, now standing at $247.6 million.

This decline in fees is contributing to Ethereum’s struggles, as on-chain activity on Ethereum’s Mainnet also decreased recently.

The Dencun upgrade is clearly affected Ethereum’s performance, and some says maybe not in a good way.

This update included EIP 4844 and reduced Layer 2 transaction costs by more than ten times, leading to a surge in L2 activity.

As a result, fees on ETH’s Mainnet have hit an all-time low, which has impacted the amount of ETH being burned and made the cryptocurrency inflationary again after previously following a deflationary trend.

The rise of Layer 2 solutions

The summer slowdown and sideways trading in traditional markets have driven on-chain fees to multi-year lows.

With lower fees and reduced ETH burning resembling a company facing declining revenues and stopping stock buybacks, it’s no surprise that ETH’s price is struggling.

On the other hand, Optimism, one of the leading Layer 2 networks on Ethereum, has seen its governance token outperform others.

In the third quarter, the OP/ETH pair grew by 28%, benefiting from increased on-chain activity on L2s and showing better performance than Ethereum itself.