Moo Deng and Hamster Kombat have seen painful declines over the past 24 hours. While HMSTR struggled from the start, MOODENG initially skyrocketed but has now fallen 45.6% from its highest price.

Extreme mega super high risk fr fr

Last week, MOODENG was the center of attention because it’s about a cute hippo, and because it skyrocketed by an freaking 1,400% during its first week.

Yet, new data shows that MOODENG now holds only a 187% increase over seven days.

Inspired by the internet sensation of Moo Deng, the cute baby hippo from Thailand, the token gained quick popularity, then lost a big chunk of it.

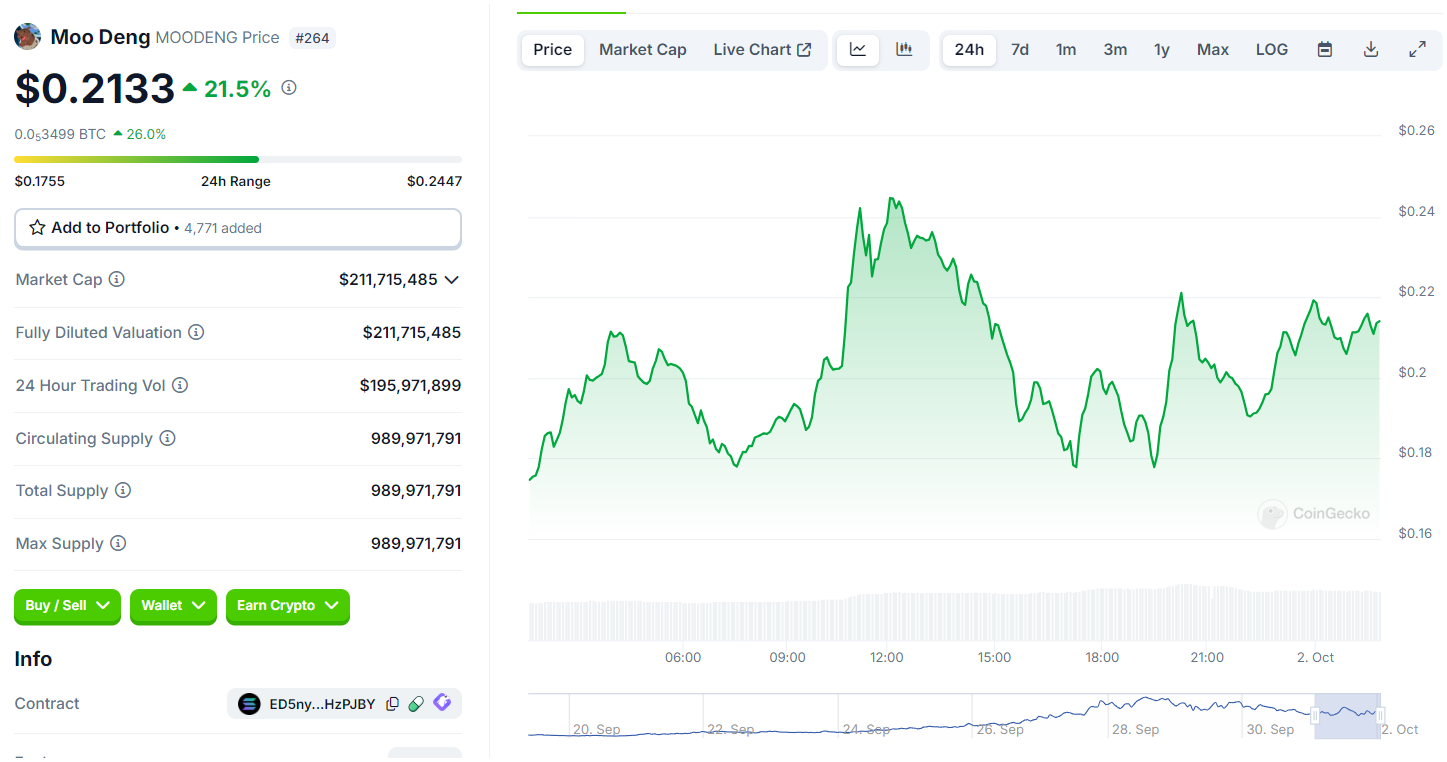

MOODENG’s current price is $0.2133. This is a quite steep decline of 45.6% from its peak on September 28, when it reached $0.3387 per token.

Right now there are 50,046 holders of MOODENG, with the top five wallets controlling 8.21% of the total supply of 989,968,154 coins.

Hamster Kombat got losses

Another token making waves is Hamster Kombat, which was launched as part of a game on Telegram and is built on the TON blockchain.

HMSTR started trading at $0.009993 but has been on a downside trend since then, hitting a new low today at $0.004802 per coin.

Over the past 24 hours, HMSTR has dropped more than 16%, what means it’s down 51.94% from its peak on September 26.

Memecoins. But who’s laughing?

A big difference between these two tokens is their distribution, because while HMSTR’s top five wallets hold a not-sus-at-all 93.95% of its total supply, MOODENG has a more evenly spread ownership among its holders.

Both tokens have attracted considerable attention and showing a huge rise in interest over the past week.

Now analysts say that we may see further volatility in both MOODENG and HMSTR as traders react to market decine. We’ll see soon.

Have you read it yet? SHIB in trouble, gains are gone

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.