Ripple’s XRP experienced a visible surge in whale activity, and investors holding over $5 million in XRP now control about 55% of the total supply.

This kind of concentration among large holders can lead to sudden price changes, but at the same time, the Mean Dollar Invested Age, the MDIA indicator for XRP has been falling, which is often seen as a positive sign for the market.

XRP’s price consolidation, something big is brewing?

In the past months XRP’s price has been stuck in a consolidation pattern, unable to break past the $0.70 range, a level it has hovered around more than a year.

But now it seems short-term selling pressure on XRP could rise, likely due to the MDIA drop, signaling that long-term holders are moving their funds.

The consolidation, coupled with these signals, hints that XRP could experience further volatility.

Dormant addresses’ activity grows

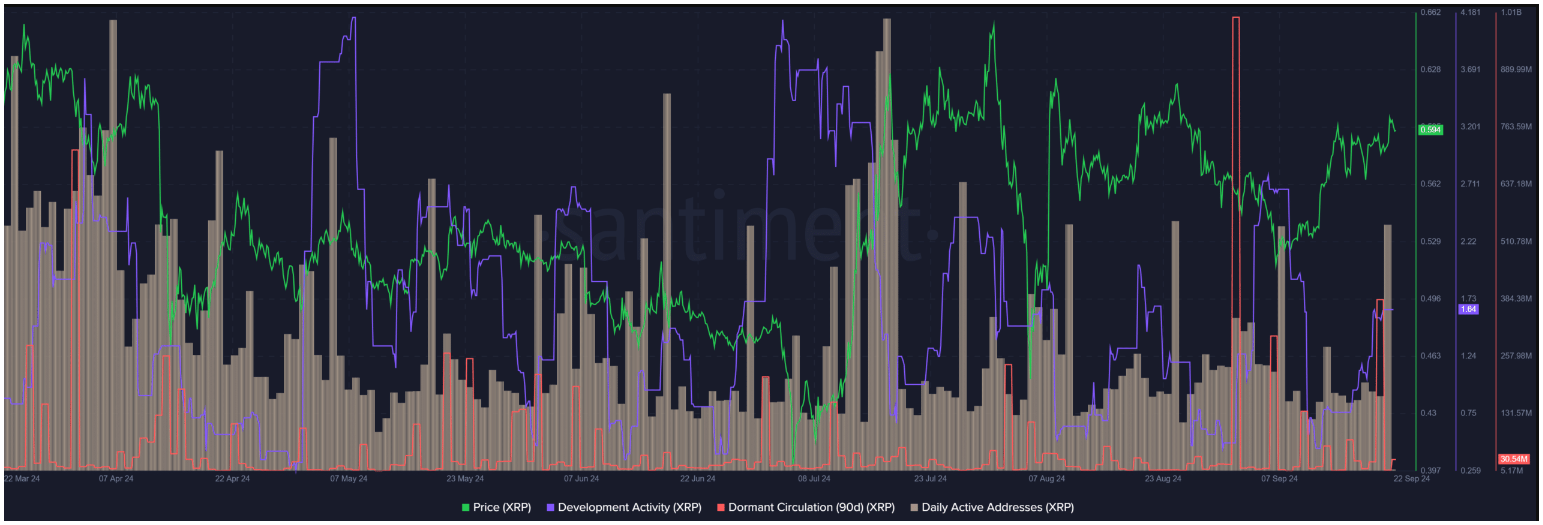

On the beginning of September, XRP’s dormant circulation saw its largest spike in over a year, signaling a wave of activity from previously inactive wallets.

Source: Santiment

The last time such a surge happened was in June last year, followed by a bigger price drop within days.

We saw almost the same now, XRP’s price plummeted by 12.18%, going from $0.572 to $0.502 just four days later.

XRP’s development activity remains strong, though it still lags behind other major cryptocurrencies like BNB in terms of gains.

Meanwhile, daily active addresses for XRP have stayed steady over the past six weeks.

Future gains on the horizon

In mid-July, XRP saw an increase in leverage alongside rising prices, but then this activity was quieted down, suggesting that speculators aren’t rushing to enter new margin positions.

This supports the idea that XRP is indeed in a period of consolidation. Another indicator, the mean coin age, also dipped but is now trying to climb again, further signaling that investors may be holding out for future price increases.

The rapid decline in MDIA indicator also suggests that coins are moving more frequently, which can be a sign of increased market activity.

When MDIA falls, like now, it generally means that long-term investments are becoming more active, hinting at a possible price appreciation for XRP.