Coinbase found itself in hot water after claims that it lacks transparency in its Bitcoin reserves.

This came after the firm introduced its wrapped Bitcoin product, known as cbBTC, which is designed to be used as collateral in the DeFi space.

Exchange Bitcoin is nothing but an IOU?

Some members of the crypto community have accused Coinbase of selling paper Bitcoin to BlackRock without having the proper one-to-one backing.

These concerns arose as users demand clarity on Coinbase’s BTC reserves related to both cbBTC and the BlackRock ETF.

In response to these allegations, Coinbase founder Brian Armstrong defended the company, telling that it undergoes annual audits by Deloitte and can’t disclose clients’ wallet addresses.

“If you want audits, Deloitte audits us annually; we’re a public company. I doubt our institutional clients want people dusting all their addresses, and it’s not our place to share for them.”

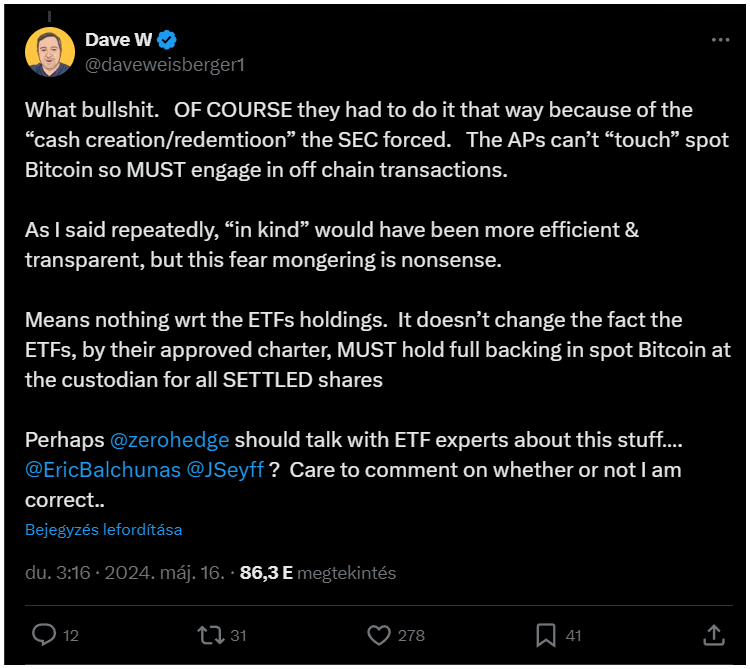

This isn’t the first time Coinbase has faced such allegations. Similar claims were made back in May, but ETF experts like Bloomberg’s ETF analyst Eric Balchunas dismissed those concerns, stating that the perceived lack of transparency was due to the ETF’s design, which didn’t include in-kind redemptions.

Balchunas also criticized the latest allegations, noting that Arkham tracks most ETF issuers and their holdings, which can be verified.

Also many ’experts’ dismissed the concerns back in the days that FTX had any financial issues…

Can we know anything about cbBTC reserves?

Armstrong’s comments about cbBTC raised more questions than they answered.

He acknowledged that users must trust a centralized custodian to hold the underlying Bitcoin.

Some community members believe that even as a centralized custodian, Coinbase should allow users to verify the Bitcoin backing cbBTC.

“As for cbBTC, yes you’re trusting a centralized custodian to store the underlying BTC – we’ve never claimed otherwise.”

Not your keys, not your Bitcoin

Transparency is a core principle of the blockchain community, and Armstrong’s remarks on cbBTC were seen as insufficient by many observers. Not a big surprise market participants expressed concern.

“They will not provide any proof of reserves for the BTC they claim they have, nor any proof of backing for their new paper BTC called cbBTC. If they print too much paper BTC, they will go the FTX route.”

Coinbase’s cbBTC is set to compete with BitGo’s WBTC, which is transitioning its custody operations to Justin Sun’s firm.

This situation may suggest that some of the allegations against Coinbase could be part of a larger struggle for market share in the cryptocurrency space.

It remains uncertain whether Coinbase will provide more information about the backing of its cbBTC product for the crypto community.