CryptoQuant’s new analysis revealed a big change in Bitcoin capital flow, with funds moving from short-term holders to long-term holders. This sounds like a bullish trend.

Transition from STH to LTH, and why this is matters?

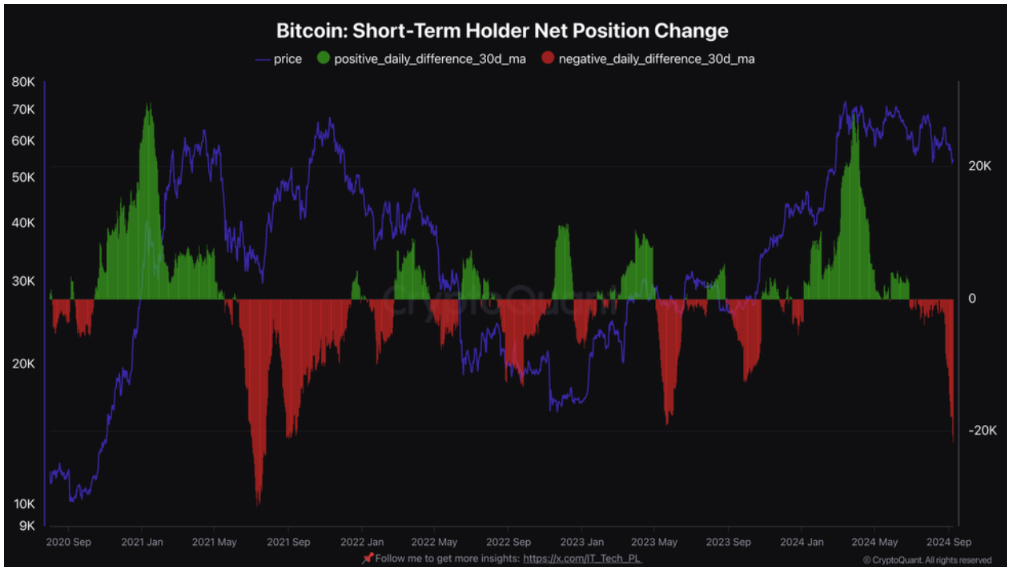

CryptoQuant analyst IT Tech, short-term investors have been selling their Bitcoin, while long-term investors are actively accumulating more.

The data shows that STH reduced their net positions big time over the past two weeks, with many exiting the market to either take profits or minimize losses.

This behavior now looks like a common trend where less confident investors respond to price volatility by lowering their exposure to Bitcoin.

And investors with lower time preference? They’re buying more.

Capital allocation influences market dynamics

Long-term holders seem to be taking advantage of the current market conditions.

IT Tech’s analysis reveals that LTH net positions are on the rise, as these investors find the current price levels pretty appealing for buying.

IT Tech also noted that the increase in LTH holdings is always a positive sign for the market, as these investors are generally seen as more stable and confident in their investments.

The overall consequences of this capital shift present a quite mixed outlook for Bitcoin.

IT Tech explained that while increased accumulation by LTH could stabilize prices and set the stage for a rebound, the sell-offs from STH might create strong downside pressure in the short term.

Right now LTH accumulation is dominating the market, so STH aren’t especially active now, but this can change quickly.

The calm before the storm?

As more and more long-term holders accumulate Bitcoin, this could lead to greater market stability and possibly a bullish rally.

The ongoing transition from short-term to long-term holders may also suggests a shift in investor sentiment, with more people viewing Bitcoin as a long-term investment rather than a quick profit opportunity.

This situation mirrors the previous market cycles where shifts in holder behavior often predicted bigger price movements.