Bitcoin investors should prepare for a challenging September, which historically offers the worst average returns for the cryptocurrency.

This warning comes from the New York Digital Investment Group, the NYDIG.

Nothing to see here

NYDIG’s global head of research, Greg Cipolaro shared that there are very few potential catalysts for Bitcoin’s price in the near future, so rising price is pretty unlikely.

He mentioned that investors might only find a handful of external factors outside the crypto space to focus on, only a few specific macroeconomic developments.

Cipolaro explained that most potential catalysts relate to macroeconomic data, like inflation, unemployment, and GDP, or monetary policy decisions made by the Federal Open Market Committee.

He pointed out that few factors are specific to Bitcoin or the crypto market.

Crab market, the annoying sideline price movement, and the end of the month is still far

Bitcoin has seen a slight increase of just over 3% in the past 24 hours, likely thanks to strong performances in the S&P 500 and the tech-heavy Nasdaq, which both reported gains of 1.16% on September 9.

But on the other hand, it’s just the counterbalance change of the weekend price action, when it declined the same amount.

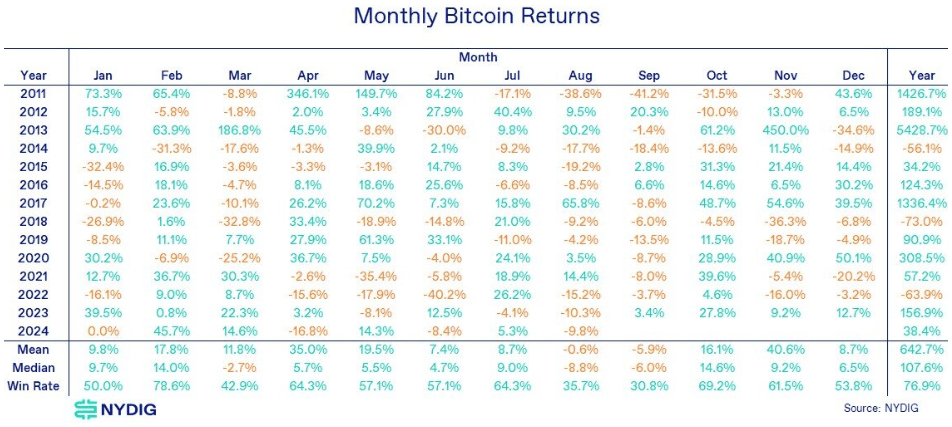

More analysts have mentioned that September is typically the worst month for Bitcoin’s price, with the averaging a loss of 5.9% over the last 13 years.

Q4 is now less than three weeks away, and it has historically been the strongest for Bitcoin, with October and November showing average gains of 16.1% and 40.6%, respectively. This sounds much better!

Uptober and Risevember

Cipolaro mentioned that one of the biggest concerns for the crypto market now is the upcoming U.S. presidential election in November, and the continuous daram surrounding it.

Former President Donald Trump already established himself as a crypto-friendly candidate, while there is much less clarity regarding Vice President Kamala Harris’s views on digital assets. This uncertainty could lead to increased volatility in the market.

“We won’t guess which candidate might win the election, but November could be a crucial time for the industry. Until then, Bitcoin may be influenced by the overall market conditions.”

As the election inching closer, market sentiment may shift, leading to unpredictable price movements for Bitcoin. But as they often says, volatility is the traders’ best friend.

Have you read it yet? Tokyo begins Bitcoin mining

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.