Bitcoin ETFs faced a tough week, we saw net outflows for seven consecutive trading days. The funds lost more than $1 billion.

Major withdrawals from multiple funds

The largest capital exit came from Fidelity’s Wise Origin Bitcoin Fund, which saw approximately $374 million leave during this period.

Grayscale’s Bitcoin ETF reported $227 million in outflows. The BlackRock iShares Bitcoin Trust, the biggest Bitcoin ETF globally, also experienced its second outflow since launching in January, with investors pulling out $13.5 million on August 29.

Not much, but still outflow. This was a clear shift from the fund’s earlier performance, which had seen steady inflows before.

Other Bitcoin ETFs, with the exception of WisdomTree’s Bitcoin Fund, also reported losses, showing a lack of significant capital inflows during this time.

ETF outflows could impact the Bitcoin prices and the market sentiment?

These outflows from Bitcoin ETFs contributed to a decline in Bitcoin’s price, which faced additional pressure from uncertainty in the global market.

On Thursday, US Bitcoin funds saw a net outflow of $211 million, which is the fourth-highest daily outflow since spring, since May 1.

Bitcoin’s price struggled to surpass the $65,000 resistance level, likely leading to ongoing selling pressure.

And the common view is also there, as september often brings losses, instead of gains.

The long-term investors in Bitcoin are still in profit, but those who have bought in the past months are facing difficulties in the current market climate.

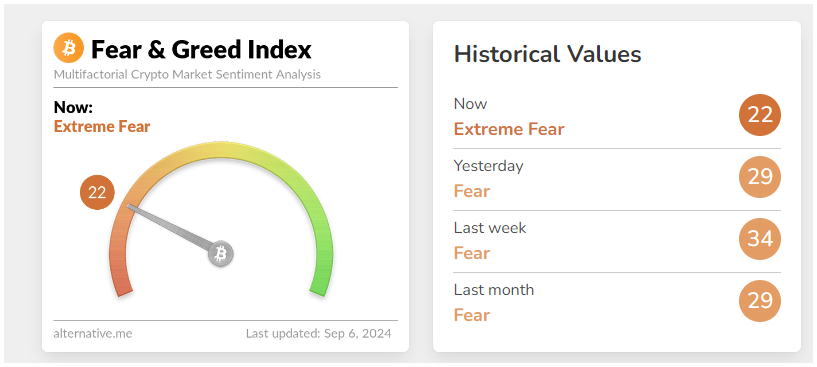

The Fear and Greed Index showss that market sentiment is still in the fear zone.

Bitcoin price performance

In the past week, Bitcoin’s price dropped over 4%, and it is currently trading around $56,500.

One can speculate that continued ETF outflows and market fears could further impact Bitcoin’s price and investor confidence in the coming days, but also worth to mention that in 5-year time horizon, it’s up 450%, and in 10-year? More than 10,000%. Zoom out, don’t think in days!

Have you read it yet? China wants to create new rules for seized crypto

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.