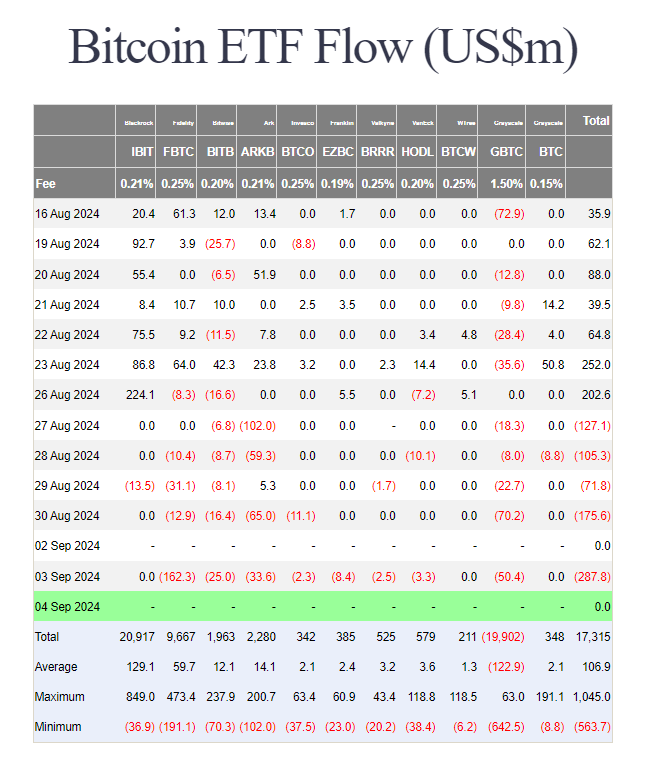

Bitcoin ETFs in the U.S. faced huge withdrawals at the start of September, with $288 million pulled out on the first trading day after Labor Day.

Sellers rule

U.S. spot Bitcoin ETFs experienced a rough start to the month, with a net outflow of $288 million on the first day back after Labor Day.

This is the fifth straight day of losses for these funds, which have now seen over $750 million in outflows since Tuesday last week.

The market faced strong selling pressure, and eight out of eleven Bitcoin ETFs reported negative flows.

Grayscale’s GBTC losing over $50 million, but Fidelity’s FBTC fund was hit the hardest, with $162 million withdrawn, marking its second-largest outflow since the fund’s launch.

Other Bitcoin ETFs, including those managed by ARK Invest/21Shares, Bitwise, Franklin Templeton, VanEck, Valkyrie, and Invesco, also saw investors pulling out their money.

Some funds, like BlackRock’s IBIT and WisdomTree’s BTCW, managed to avoid outflows now.

Grayscale’s influence on the Bitcoin ETF market

Grayscale’s GBTC fund is approaching a milestone that likely no ETF wants to reach, the $20 billion in net outflows.

Despite some slowing down, the fund is still losing capital, and the dip in Bitcoin’s price just reduced Grayscale’s assets under management to about $13 billion.

Also worth to mention that part of these outflows came from companies in the crypto space that went bankrupt in 2022 and 2023, holding Grayscale’s Trust shares.

When Grayscale converted to an ETF, these companies sold their shares to repay creditors.

BlackRock dominance

The main takeaway is that Grayscale isn’t a dominant player on the field anymore, its position was taken over by BlackRock.

BlackRock’s IBIT ETF attracted nearly $21 billion since its launch, making it the largest Bitcoin ETF in the world.

Have you read it yet? Bitcoin mining difficulty grows, tough times ahead

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.