As Bitcoin’s price dipped below $58,000, a Bitcoin whale went to a shopping spree, capitalizing on a period of others’ fear.

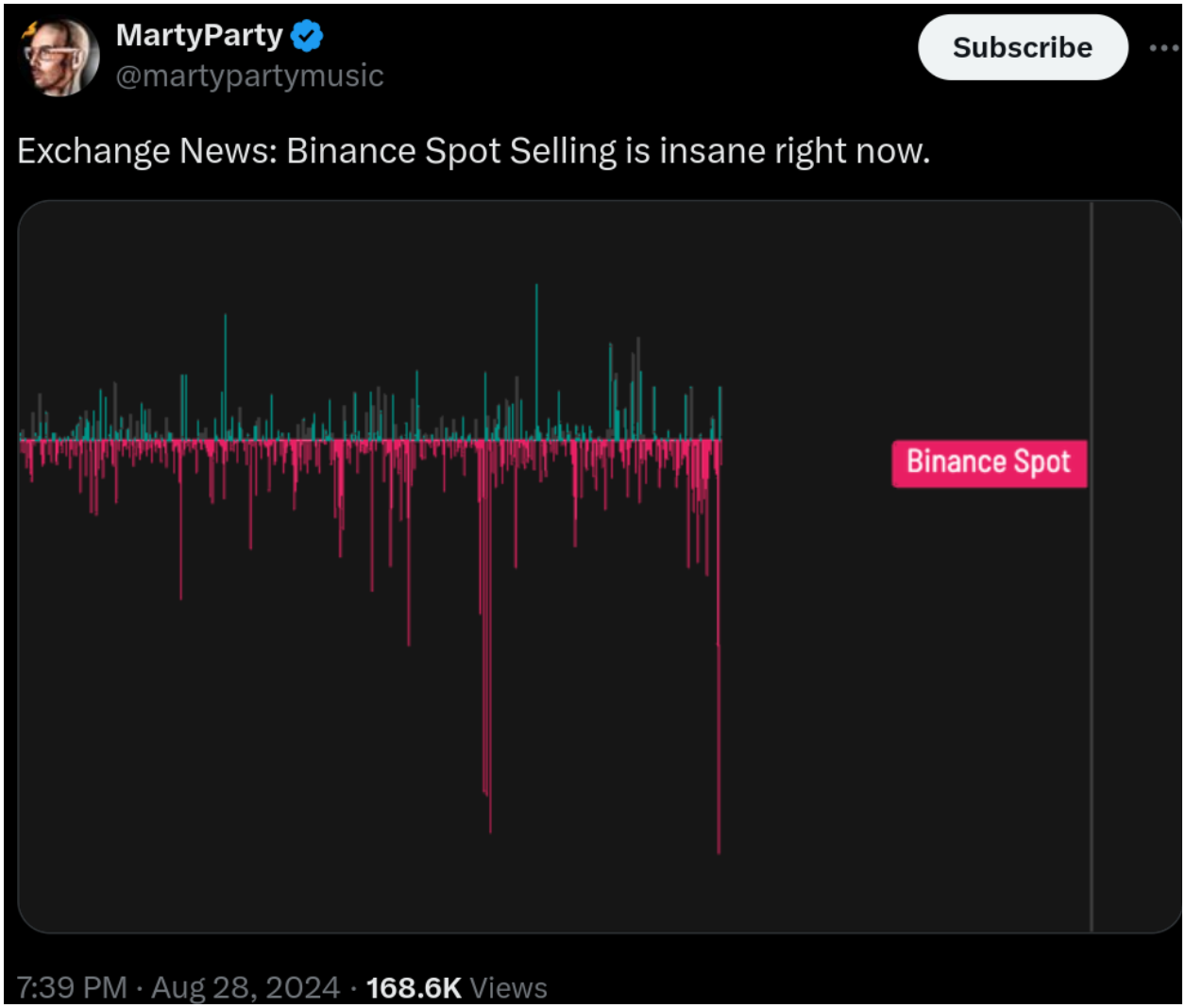

Binance sell-off

In the past days, Bitcoin’s price attempted to climb back to $60,000 after experiencing a drop, touching a two-week low of $57,900 on Bitstamp.

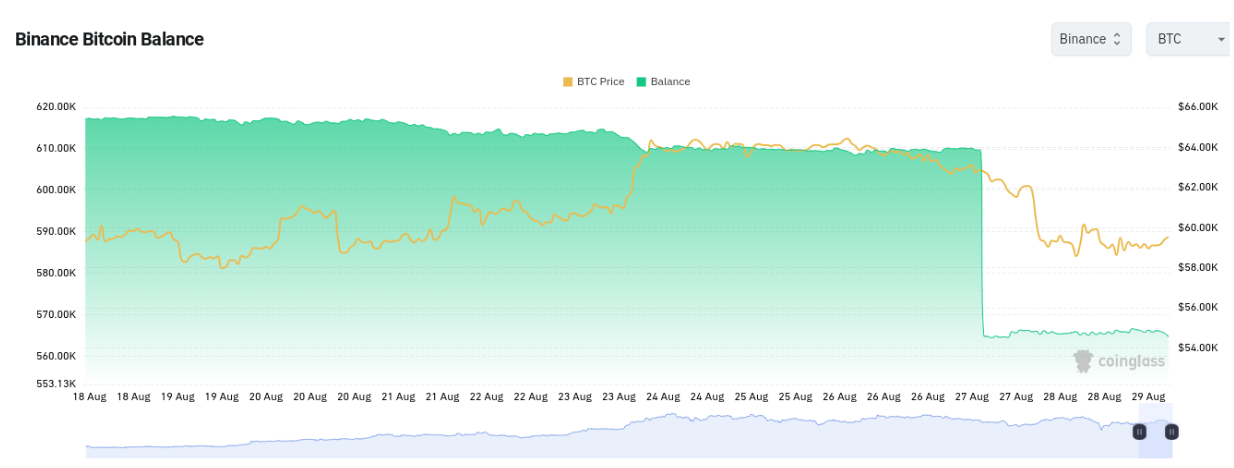

The decline was largely attributed to intense selling pressure on Binance. Market watchers shared that the sell-off was particularly severe during U.S. trading hours and appeared to be linked to a controversy involving funds tied to users in Palestine.

Binance was accused to stealing these assets, and the ’not your keys, not your coins’ saying suddenly looked like a warning, instead of a simple phrase.

This event led to a fast withdrawal of 45,000 BTC from Binance’s reserves.

The well-known trader, Michaël van de Poppe predicted that Bitcoin’s price might fall further to around $56,000, especially after it failed to hold above the $61,000 level on shorter timeframes.

#Bitcoin lost the crucial support level at $61K.

Either through the Telegram / $TON news or through the Binance rumor.

At least, it's lost the crucial level.

What's next?

Likely a test at $56K before reversal, if the markets want to rally, $62K is your crucial resistance. pic.twitter.com/WLHyBSCjnQ

— Michaël van de Poppe (@CryptoMichNL) August 28, 2024

He told that losing this price point was important for future market movements.

Discounted coins

As always, some large investors saw the dip as a good buying opportunity.

The analytics platform Lookonchain reported that a single Bitcoin whale bought nearly $60 million worth of BTC, seizing the chance to accumulate a nice stack at lower prices.

A whale bought 1,000 $BTC($59.65M) from the bottom 55 minutes ago and currently holds 7,559 $BTC($450M)!

This whale sold 7,790 $BTC($468.3M) between Jun 27 and Jul 8 before.

Address:

3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhN pic.twitter.com/JPjSOHUm83— Lookonchain (@lookonchain) August 29, 2024

Santiment shared the same story, and told that large holders, often referred to as whales and sharks, were also steadily increasing their Bitcoin positions.

🐳 Bitcoin currently sits at $58.9K, which is apparently just fine for whale and shark holders. Over the past month, wallets with 10-10K BTC have collectively accumulated 133.3K more coins while smaller traders continue to impatiently drop their holdings to them. pic.twitter.com/CmOU1tdVwN

— Santiment (@santimentfeed) August 28, 2024

Over the past month, wallets holding between 10 and 10,000 BTC added an additional 133,300 coins, while smaller traders were more likely to sell off their holdings in response to market fluctuations.

Future price

Trader and analyst Rekt Capital observed that Bitcoin was continuing to consolidate within a narrowing wedge pattern on the weekly charts.

In this way, Bitcoin formed a higher low, maintaining itself just above the weekly support level of around $55,737.

So as of now, Bitcoin established a base at a slightly higher level of around $58,000, which Rekt Capital identified as a confluent support.

This level was being tested again as the market continued to show signs of a potential breakout.