Rumors are circulating that Kamala Harris may support a tax on unrealized capital gains if she becomes President, and this move could potentially impact crypto investors.

Tax agenda

There are rumors that Kamala Harris’s campaign signaled support for tax increases on wealthy individuals, following the proposals already outlined by President Biden.

The Committee for a Responsible Federal Budget, CRFB shared the Harris campaign has committed to backing “all of the tax increases on high earners and corporations” that are part of Biden’s budget plan.

Marc Goldwein, senior vice president at the CRFB also noted that these tax proposals are not directly mentioned in Harris’s specific campaign plans but are aligned with the broader Democratic platform.

Biden’s 2025 budget proposal includes a recommendation for a minimum tax of 25 percent on total income, which would include unrealized capital gains.

This idea was echoed in the Democratic Party’s 2024 platform, which calls for a 25 percent income tax on billionaires and wants to eliminate the preferential treatment of capital gains for millionaires, making sure that they pay the same rate on investment income as on wages.

Maybe one of the most common critics against this is simply that measurable part of the politicians are already a millionaire, working for, or behalf of a billionaire, so voting a law which will cut their income is very, very unlikely. But sounds good enough plan to get votes.

Only the wealthy

Some thinks the proposed tax on unrealized gains would only apply to the wealthiest Americans, those with a total income or wealth exceeding $100 million.

Some crypto influencers have sounded the alarm, suggesting that Harris is pushing for a 25% tax on unrealized gains and a 45% tax on long-term capital gains, creating unnecessary panic among average investors.

But this is also not surprising from influencers. They seemingly thriving on drama.

Adam Cochran, a partner at Cinneamhain Ventures, clarified on Twitter that the Harris campaign has not specifically endorsed a new unrealized gains tax, and even if such a tax were proposed, it would not impact the vast majority of investors.

“So no, she did not endorse an unrealized gain tax, and even if she did, you don’t earn enough for it to impact you.”

Bad precedent

The concept of an unrealized gains tax raises concerns for many, despite the lack of information.

Critics argue that such a tax could have severe consequences for the economy, given the simple fact, taxing unrealized gains is maybe the most idiotic, stupidest idea in the history of taxation.

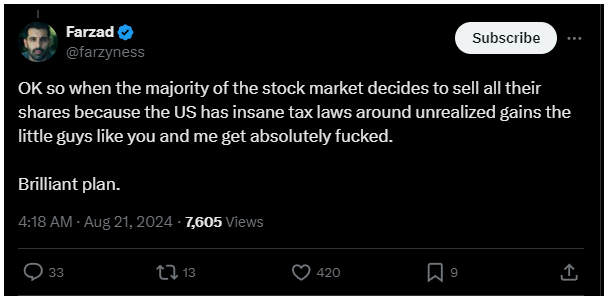

YouTuber Farzad Mesbahi warned that if such a tax were implemented, it could trigger a massive sell-off in the stock market, disproportionately harming smaller investors.

Jameson Lopp, co-founder of Casa, also voiced concerns, noting that while the tax might initially target only the ultra-wealthy, history shows how taxes can, and are expand over time.

He pointed out that income tax worked similarly. It began as a modest 1% tax in 1913 targeting only the top earners, eventually grew to almost 50% in that level.

Have you read it yet? McDonald’s Instagram hacked, pushing fake memecoin

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.