BlackRock, the world’s largest asset manager reached the top spot in crypto ETF holdings, surpassing Grayscale, a long-time leader in this space.

The new kid in the block

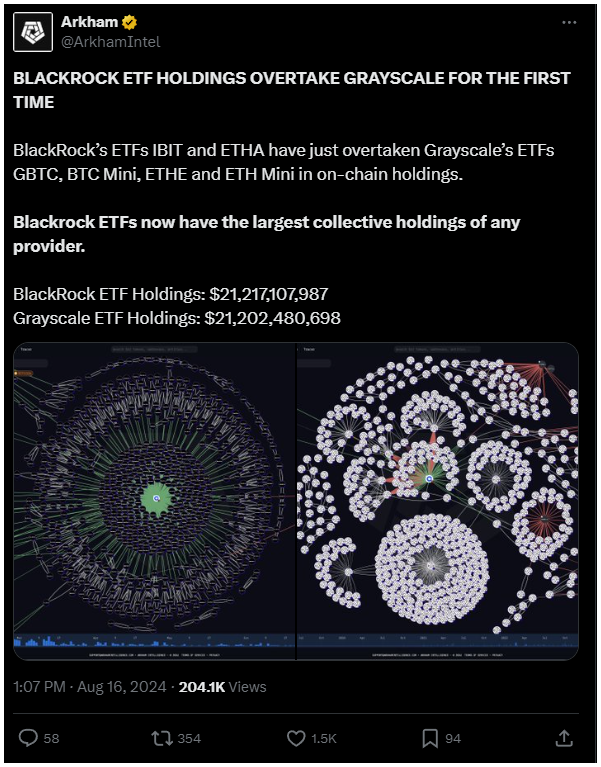

Arkham announced that BlackRock now holds the largest amount of crypto assets in its ETFs, dethroning Grayscale.

BlackRock’s ETFs currently manage assets worth $21.22 billion, slightly edging out Grayscale’s $21.20 billion in assets under management.

And BlackRock accomplished this with just two funds, the IBIT, a spot Bitcoin ETF, and ETHA, a spot Ethereum ETF, while Grayscale offers four different funds, including GBTC, BTC Mini, ETHE, and ETH Mini.

Grayscale still maintains a higher overall balance due to its GDLC fund, which is not classified as an ETF and holds $460 million in AUM, BlackRock’s rise to the top spot in the ETF category is a big shift in the crypto investment sector. It’s the end of an era, and the start of a new one.

The recipe of success

Since launching its spot Bitcoin ETF, IBIT, in January, BlackRock has seen huge success in the ETF market. IBIT experienced only one day of outflows since its inception.

In stark contrast, the Grayscale Bitcoin Trust recorded only 12 days of inflows since its launch, resulting in a big net outflow of $19.65 billion, likely due to the way higher fees.

This ongoing trend clearly contributed to Grayscale losing its dominant position to BlackRock.

Also, there are big move from banks like Morgan Stanley and Goldman Sachs.

Morgan Stanley, for example, reportedly offloaded nearly all of its $270 million position in GBTC shares in favor of BlackRock’s, signaling a pretty strong preference for iShares Bitcoin ETF.

Ethereum ETFs are like Bitcoin ETFs?

While Bitcoin ETFs, especially those offered by BlackRock, have seen a positive influx of capital, the same cannot be said for Ethereum ETFs.

They had a promising start, but then spot Ethereum ETFs ended the week with a net outflow of $14.17 million.

In contrast, Bitcoin ETFs recorded a total net inflow of $32.57 million over the same period.