XRP whales are back in action, accumulating more of the cryptocurrency, and there’s more happening beneath the surface that suggests XRP might be ready for a bigger rally.

Signs

After the developments with the SEC that hint at substantial future movements on the charts, XRP is in the sight of the traders, again.

The Bollinger Bands on the monthly chart are tightening, signaling that XRP is in a phase of consolidation. This signal often precedes a major price movement.

Analyzing XRP’s dominance chart, which filters out the noise from the XRP/USD pair, finally reveals a pattern of market outperformance.

This reversal from typical levels that usually come before major rallies is considered as a strong signal.

With monthly volatility at its lowest point, and other indicators suggesting a bottoming out, XRP may be heating up for a nice rise.

What does the XRP chart say?

On a weekly timeframe, XRP already outperformed the whole market for ten consecutive weeks, signaling a strong potential for an uptrend in its price against the US dollar.

Now the movement in XRP/USD is pretty boring, but the overall market cap for XRP shows undeniable and sustainable strength. This also could bring future gains, backed by robust market metrics.

Further supporting this outlook, the MACD indicator too on the monthly chart has turned bullish.

Hi all. Let me update the monthly time frame on #XRP.

1. I shared the timeline below almost a year ago, before the $0.93 run (we targeted it at $0.89 when XRP was around 28 cents).

2. Then, we discussed the possibility of touching $0.3917 and called it the last frontier.

3.… pic.twitter.com/dF2GpMTA79

— Dark Defender (@DefendDark) August 8, 2024

Another indicator, the so-called Dragonfly Doji formation suggests increasing buying pressure.

On the X, popular analyst Dark Defender shared that the technical analysis shows that XRP is currently in a Wave 3 structure on the monthly timeframe, with targets set at $1.88, $5.85, $18.22, and $36.76. If XRP can break above $0.66, it’s likely to quickly rise to $1.03.

And then, holding above $1.03 would push XRP into a highly bullish zone, even above the Ichimoku Clouds.

The SEC, the whales, and the bright future

Given these technical indicators and the new SEC-related developments, XRP could be on track to reach these ambitious targets.

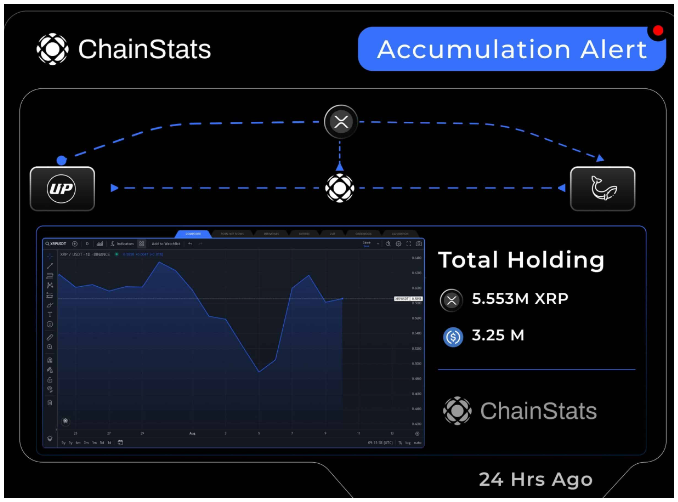

Also, there has been a visible increase in whale activity. A large XRP holder added 7.0 million XRP, worth approximately $4.1 million, to their holdings from UPBIT within a single day.

This acquisition brought their total holdings to 5.553 million XRP, valued at $3.25 million.

Such accumulation by whales is often interpreted as a bullish signal, suggesting that major investors are positioning themselves for price increases in the coming months.

Have you read it yet? Ethereum’s price could drop to $1,651

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.