Norway’s sovereign wealth fund, Norges Bank Investment Management, the NBIM, has become a big holder of the world’s first cryptocurrency. Or something like that.

Bitcoin in the big league

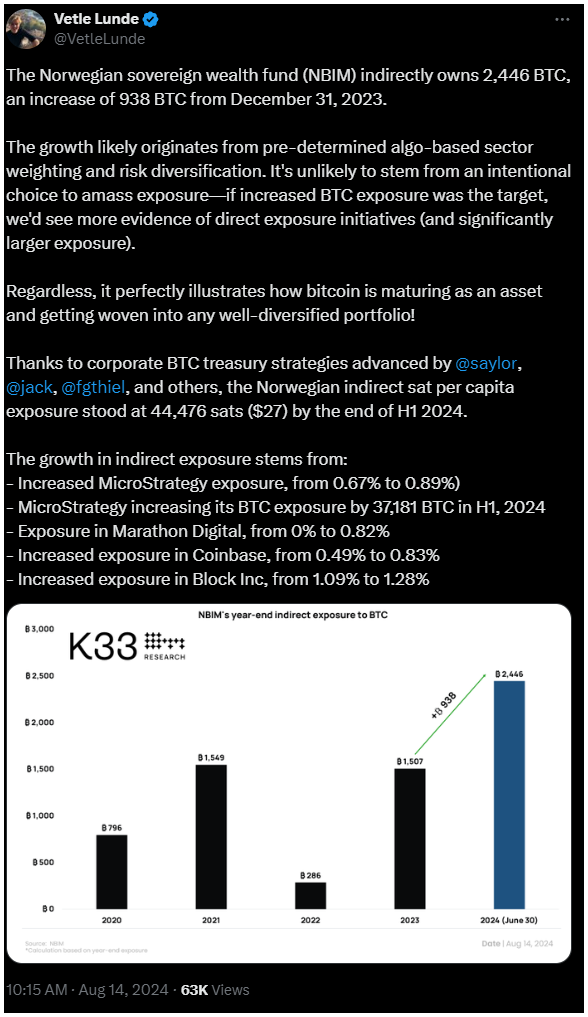

K33 Research analyst Vetle Lunde has uncovered that NBIM, which oversees the Norwegian Government Pension Fund Global, now indirectly holds 2,446 Bitcoin.

This is a quite big increase of 938 BTC since the end of 2023.

Lunde suggests that this growth likely comes from pre-determined algorithmic sector weighting and risk diversification strategies rather than a direct intent to accumulate Bitcoin.

He explained that if NBIM had specifically wanted to boost its Bitcoin holdings, there would likely be clearer evidence of direct investment efforts and a way larger exposure.

Despite the passive, indirect nature of NBIM’s Bitcoin accumulation, the fund’s growing exposure clearly shows Bitcoin’s maturation as a recognized asset class.

This development is also reflective of the broader trend, where corporate Bitcoin treasury strategies, championed by figures like Michael Saylor of MicroStrategy and Jack Dorsey of Block Inc., have increased the visibility and viability of Bitcoin in traditional financial circles.

By mid-2024, the Norwegian per capita indirect Bitcoin exposure had reached 44,476 sats.

What they acquired?

Lunde’s analysis sheds light on the specific factors driving NBIM’s increasing indirect Bitcoin exposure.

The increased their stake in MicroStrategy, and NBIM’s exposure rose from 0.67% to 0.89%.

MicroStrategy has been a major corporate advocate for Bitcoin, also significantly expanding its BTC holdings.

MicroStrategy’s own Bitcoin expansion also not a marginal factor, as in the first half of 2024, MicroStrategy increased its Bitcoin holdings by 37,181 BTC, further enhancing NBIM’s indirect exposure.

The NBIM got new position in Marathon Digital, after they acquired a 0.82% stake in the company, a leading Bitcoin miner known for accumulating Bitcoin on its balance sheet. They also grew their exposure to Coinbase.

Now NBIM’s stake in Coinbase, the largest cryptocurrency exchange in the U.S., grew from 0.49% to 0.83%, reflecting the exchange’s rising influence.

NBIM’s investment in Block Inc. increased from 1.09% to 1.28%. Block, co-founded by Jack Dorsey, has been a strong proponent of Bitcoin integration into its financial services ecosystem.

Gradually, then suddenly

The majority of experts agree that NBIM’s growing Bitcoin exposure might not be the result of a deliberate accumulation strategy, as Lunde suggests, it nonetheless signals a visible trend of increasing acceptance and integration of Bitcoin among global financial institutions.