On-chain data shows that Bitcoin permanent holder addresses have added nearly $23 billion worth of Bitcoin over the past month.

This big time accumulation already sparked curiosity and speculation within the crypto community.

Commitment is unbeatable

CryptoQuant founder and CEO, Ki Young Ju highlighted this trend on X, and he noted a dramatic increase in the 30-day demand change for permanent Bitcoin holders.

I'm pretty sure something is happening behind the scenes.

404,448 #Bitcoin have moved to permanent holder addresses over the past 30 days, and it's clearly accumulation.

We'll know within a year. https://t.co/Ip0jow2pGN pic.twitter.com/OOxuWcyxJu

— Ki Young Ju (@ki_young_ju) August 6, 2024

Over the past month, approximately 404,448 BTC, equivalent to $22.8 billion, have been transferred to these addresses, signaling a clear accumulation pattern.

Ki Young Ju speculates that within a year, traditional financial institutions, corporations, governments, or other entities might reveal their Bitcoin acquisitions from Q3 2024.

And in this case, he predicted that retail investors might regret not buying Bitcoin earlier due to concerns about various macroeconomic factors.

When BlackRock buying like there is no tomorrow, we don’t know what are they waiting for btw.

Indicators say we are in bull market, regardless of the price dump

Ki Young Ju also pointed out multiple bullish indicators, like the nearing end of miner capitulation and Bitcoin’s hashrate approaching all-time highs.

U.S. mining costs now are around $43,000 per coin, suggesting that the hashrate is likely to stay pretty stable unless prices drop below this threshold.

He observed that retail investors are largely absent, similar to the situation in mid-2020, and there has been reduced activity from long-term holders, who had been selling between March and June but are currently not doing anything.

Based on these views, Ki believes the bull market is here. But he also shared that he might reconsider his position if the market does not recover within two weeks.

Whale accumulation

In late July, Ki noted the substantial flow of Bitcoin to permanent holder addresses, such as those linked to exchange-traded funds.

He stressed that not all remaining BTC is in custody wallets, but the accumulation by whales is at an unprecedented level.

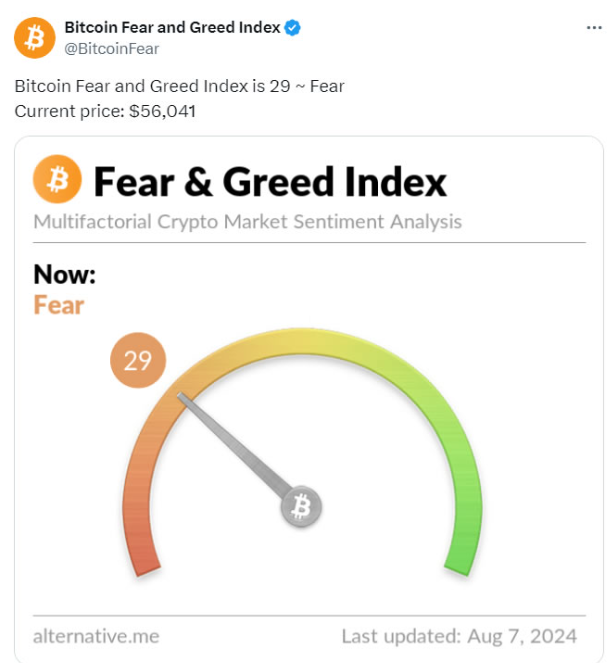

Their buying spree just intensified following the market drop on Aug. 5, which saw Bitcoin prices plunge to $49,800.