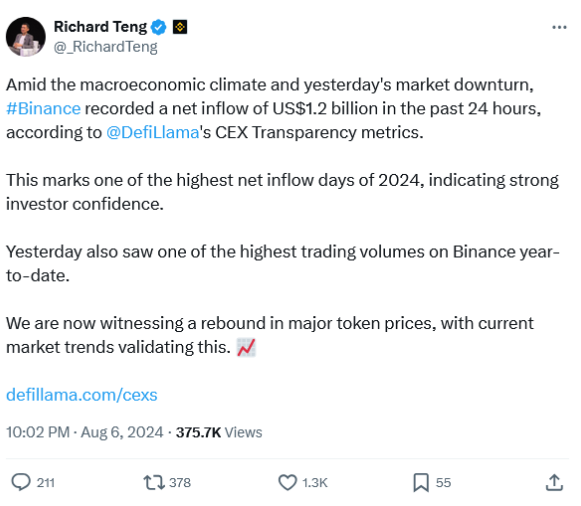

Binance, the world’s largest cryptocurrency exchange, saw a net inflow of $1.2 billion within 24 hours earlier this week.

Some says it’s the evidence of investor confidence, but we don’t know how a triggered sell-off would be an evidence for this.

Bitcoin slides to sub $50k

After the plunge hodlers got the chance to buying the dip around $49k, but since then Bitcoin has been gradually recovering, reaching around $55-$56k in time of writing.

Binance is not the only exchange which experienced bigger than usual volumes. ByBit, Crypto.com and OKX’s inflows have also grew big, they saw $100-$300 billion deposits in the same day.

Anton Toroptsev, Marketing Director for the CIS region at Bitget exchange predicts that Bitcoin prices could rebound to over $60k by the end of the week.

He noted that the next rebound could be as rapid as the decline, suggesting that BTC might return to $58k by mid-week and surpass the $60k mark by week’s end. That woud be a really nice 20% weekly return for the buyers if they bought at $50k.

Why Bitcoin is going down?

Analysts at CryptoQuant say the sharp decline in Bitcoin’s price was likely caused by various macroeconomic factors and market sell-offs.

This new dip to $49k is the lowest since February 14. Contributing factors include higher interest rates in Japan, worse-than-expected unemployment data in the U.S., geopolitical turmoil in the Middle East and U.K. riots.

Robinhood’s trading suspension

While many rided the trading frenzy, not all platforms managed to cope seamlessly. Robinhood, the popular brokerage firm temporarily suspended its overnight trading services due to issues with Blue Ocean ATS, the third-party firm responsible for its round-the-clock trading.

This decision was announced in a post on X, citing execution venue problems as the reason for the halt.