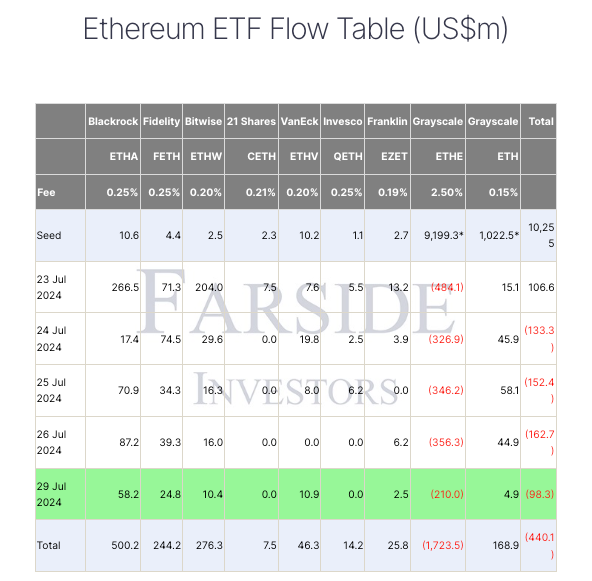

Ether ETFs saw net outflows of $98 million on July 29, marking the fourth consecutive day of declines. But there are opinions about this trend may soon reverse.

Grayscale, the bear power of the crypto ETF market?

An analyst predicts that the large outflows from Grayscale’s newly converted Ether ETF, the Grayscale Ethereum Trust (ETHE), should end by the end of this week.

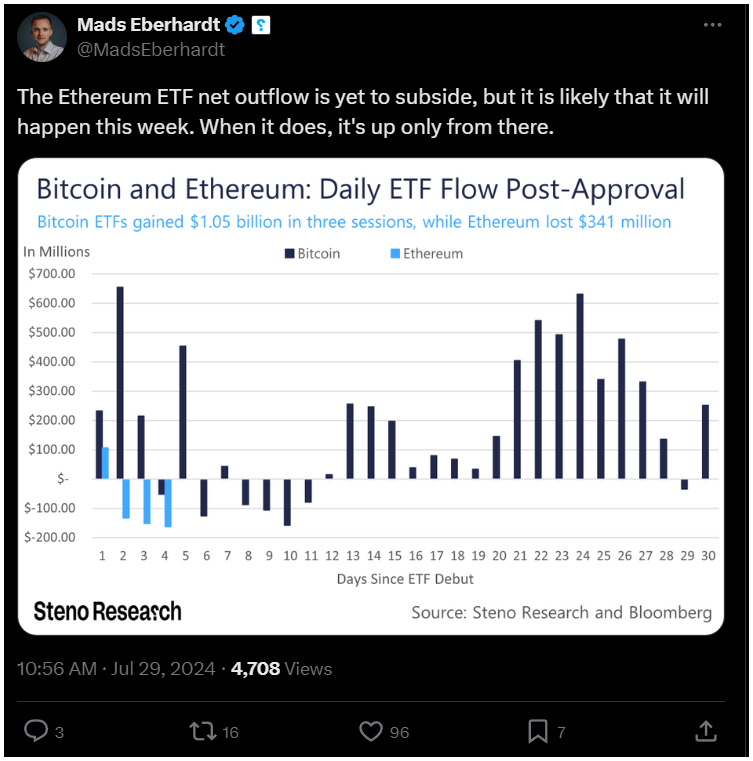

This should boosting the price of ETH. On July 30, Mads Eberhardt, a senior analyst at Steno Research shared that the giant outflows from ETHE are likely to subside soon.

Ether ETFs faced outflows for four straight days, totaling $98 million.

Since converting to an ETF on July 24, ETHE already lost over $1.7 billion in outflows, nearly 18% of its original $9 billion value.

The invested money became redeemable, and the investors aren’t wait. These outflows were what prevented Ether ETFs from seeing net inflows over the past four days, even though the other eight ETH ETFs have consistently posted positive flows.

This is very similar to what we saw in case of Bitcoin ETFs. BlackRock’s iShares Ethereum Trust received the largest inflows, at $500 million, followed by the Bitwise Ethereum ETF with $276 million, and the Fidelity Ethereum Fund with $244 million in net inflows. All was crushed by Grayscale outflows.

Ethereum’s supply is infinite, but the issuers’ stack are limited

Despite the heavy early outflows, Eberhardt thinks there is a reason for short-term optimism, as he pointed out that the Grayscale Bitcoin ETF outflows significantly subsided after the eleventh trading session.

Given that the Grayscale Ethereum ETF has experienced a much higher outflow relative to its assets under management, he believes that the peak outflow will occur sometime this week.

Eberhardt asked his followers to guess what would happen after moving past the peak of these outflows.

A trader known as Evanss6 supported Eberhardt’s view by comparing the launches of spot Bitcoin ETFs and Ether ETFs.

Have a look at the two ETF launches side by side

BTC ETF (0 on x-axis = Jan 10th):

-bottomed on Day 12 (Trading Day 7)

-bottom occurred at ~21.5% off local peak

-bottom occurred at cumulative Grayscale outflows of ~13.2%

-proceeded to rip ~92% in 50 daysETH ETF (0 on x-axis =… pic.twitter.com/jsmcYu0UD0

— Evanss6 (@Evan_ss6) July 29, 2024

Evanss6 noted that Bitcoin ETF outflows bottomed on the seventh trading day, with Bitcoin surging around 90% in 50 days after the outflows hit their lowest point.

In contrast, Grayscale’s Ether ETF was sold much faster, reaching 17.3% outflows in just four days, with a less serious impact on ETH’s price compared to BTC at the same stage.

Investors want Ethereum

Of course, the bigger picture is not that grim what it looks. Samara Cohen, BlackRock’s chief investment officer for ETF and index investments, stated that there is strong institutional demand for ETH exposure.

She added that crypto-based ETFs would start appearing in model portfolios by the end of 2024. Cohen explained that investors are keen to include ETH in their portfolios within a trusted ecosystem.

Have you read it yet? Vaneck: Bitcoin to $2.9 million by 2050

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.