Despite the visible drop in positive Bitcoin discussions online, BlackRock’s investors continue to pour money into Bitcoin ETF, like there is no tomorrow. They know math, and it shows.

The first rule of buying Bitcoin is you always buying Bitcoin

BlackRock’s iShares Bitcoin Trust, the IBIT attracting millions in investments daily, even though hype and buzz for Bitcoin has weakened on social media.

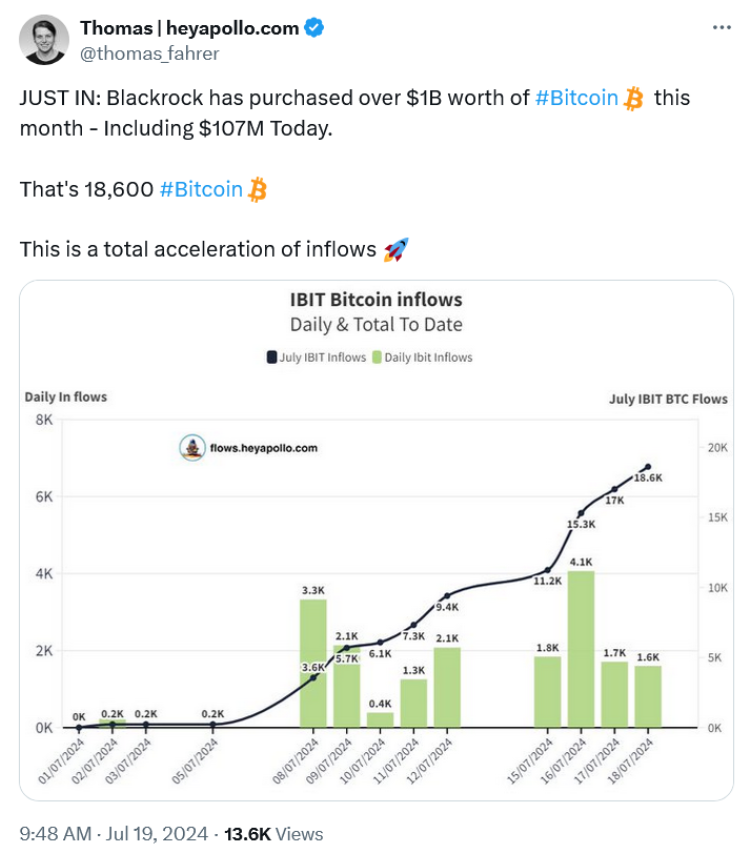

According to Thomas Fahrer, co-founder of crypto data platform Apollo, IBIT received an additional $107 million in inflows on July 18, marking the ninth consecutive day of such a positive activity.

Seven of these days saw inflows exceeding $100 million, a rare achievement in the ETF industry.

Where is the love?

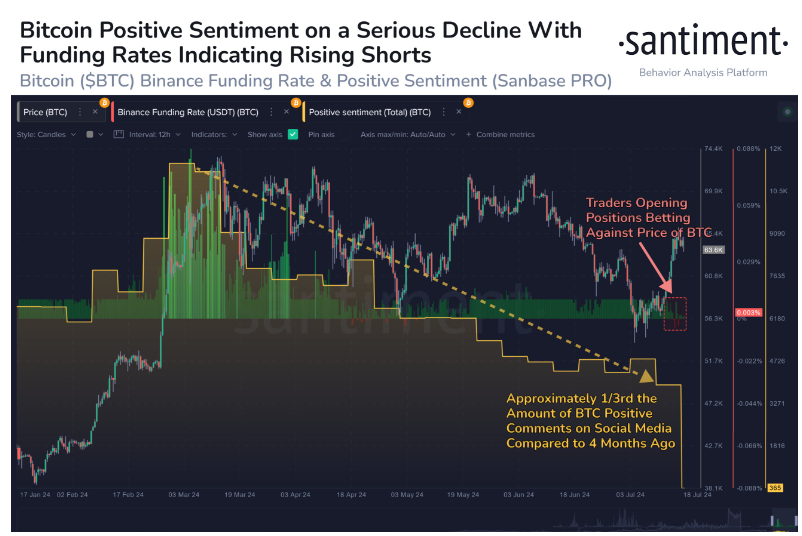

While investment in IBIT remains strong, crypto traders are way less optimistic. If we compare the amount of positive comments about Bitcoin to what we had four months ago, we see a decline.

Many traders, especially on platforms like Binance, are now taking short positions, awaiting further declines in Bitcoin’s price.

Santiment, a blockchain market intelligence firm notes that positive commentary dropped sharply, despite a moderate market rebound this week. People are simply uninterested.

Santiment measures social sentiment from platforms such as Reddit, X, 4chan, and BitcoinTalk, and now their data shows that positive Bitcoin mentions are now just a third of what they were four months ago.

Of course, there was an increase in “buy the dip” mentions when Bitcoin’s price neared a five-month low of $53,600, but that’s over.

Gimme gimme gimme!

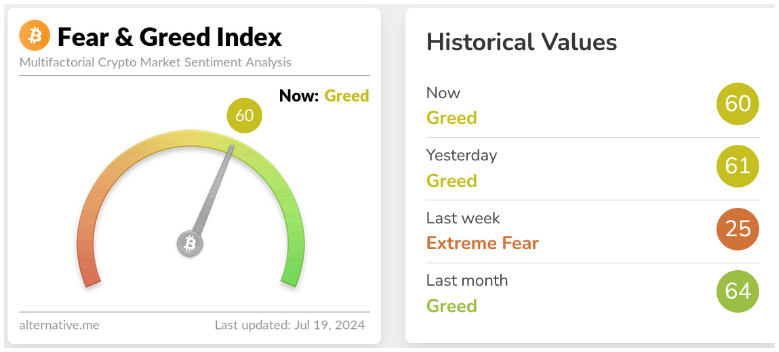

Despite the fall in positive mentions, the Crypto Fear & Greed Index shows that market sentiment is currently in the “Greed” zone with a score of 60 out of 100.

This is a huge recovery from the “Extreme Fear” zone reached on July 12, barely a week ago, when the score was 25 out of 100, the lowest since January 2023.

Bitcoin’s price now, in the time of writing stands at $63,540, up 11.5% over the last two weeks.

Have you read it yet? VanEck Bitcoin ETF integration in French retirement plans

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.