Germany’s Bitcoin reserves have seen a painful decrease, falling to just 9,094 BTC after several large transactions to various crypto exchanges. Even a German lawmaker criticised this decision.

Sell it all!

The German government has been transferring Bitcoin seized from a pirating website, to eexchanges.

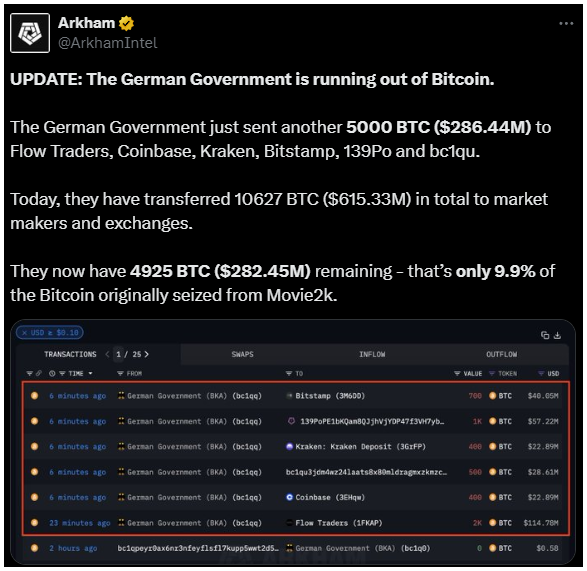

There were sellings and buybacks too, we already posted about it. On July 11, their Bitcoin wallet briefly dipped below 5,000 BTC after sending 10,620 BTC, worth $615 million, to exchanges like Coinbase, Bitstamp, Kraken, Flow Traders, and two anonymous addresses.

This information was reported by the blockchain intelligence firm Arkham first. But soon after, some of these funds were moved back to the government’s wallet, bringing their holdings back above 9,000 BTC.

How to lost a fortune

These movements mean that Germany now holds only 18% of the 49,857 BTC it initially seized, which is worth about $520 million.

Arkham’s experts suggests that the anonymous addresses involved in these transactions might belong to institutional deposit or over-the-counter trading service providers, though this hasn’t been confirmed.

German lawmaker and Bitcoin supporter Joana Cotar loudly criticized the government’s mass sell-off, suggesting that Bitcoin could have been used as a strategic reserve currency for the country, to protect against traditional financial risks.

Also, in the social media, the German government’s move got huge backlash and criticism from users, and as always, some really funny memes just born.

🚨MASSIVE BREAKING🚨

EXCLUSIVE FOOTAGE REVEALS PANIC WITHIN GERMAN GOVERNMENT OVER BITCOIN SALES

— Daniel Sempere Pico (@BTCGandalf) July 9, 2024

More decline coming?

The sell-off, along with concerns that Mt. Gox is starting to distribute over $8 billion in Bitcoin to its victims, has contributed to a recent decline in Bitcoin’s price, or at least, this is the main concern among traders and investors.

This negative trend pushed the Crypto Fear & Greed Index into the Extreme Fear zone for the first time since January 2023.

The price of Bitcoin declined around 15% in the last 30 days.

Have you read it yet? Crypto users aren’t that optimistic anymore

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.