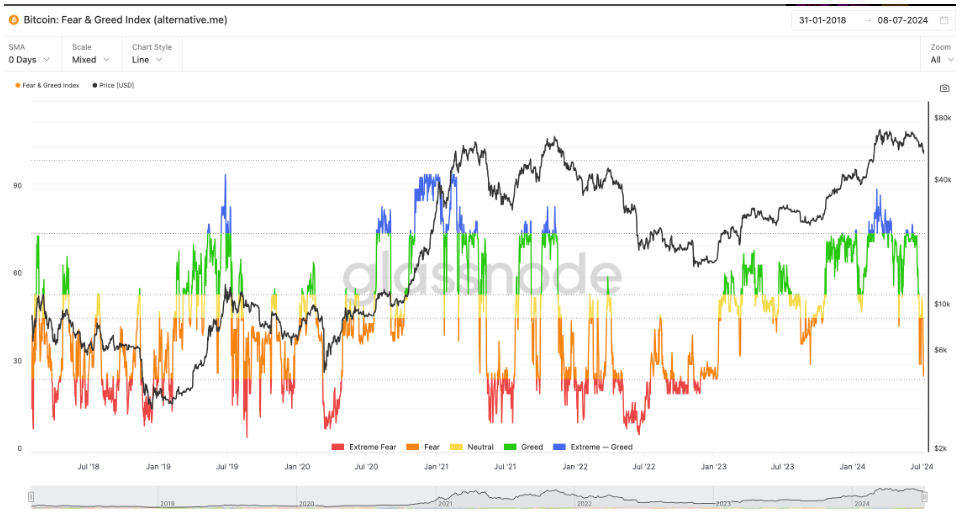

The Bitcoin Fear & Greed Index, the famous or infamous indicator which tracks the overall market sentiment, just dropped to its lowest level since January 2023, reaching 27.

Dumpster fire on the Bitcoin market

This metric measures how traders and investors feel about the market, shows that people are very worried right now, likely due to the big selling wave.

Last time we saw this level back in January 2023, just two months after the FTX exchange collapsed, when the index was at 26.

Bitcoin was trading at around $16,500, and by the end of that month, the price climbed back to around $22,000. But worth to mention long time hodlers weren’t affected. No trading, no fear.

When the sellers are out of Bitcoin, they can’t print more

The current market fear is probably being driven by two major events. First, the German government is selling off its Bitcoin holdings, causing the price to drop from about $63,000 at the end of June to around $53,000 on July 5.

The German government is selling tens of thousands of Bitcoin in batches, and there is no MicroStrategy now to purchasing all of it.

They moved an additional $276 million worth of Bitcoin to their selling wallet, and they still have around 22,800 BTC.

But many experts warn that this might looks huge, compared to the total daily trading volume, isn’t big deal at all.

And compared to the total stack of the individual Bitcoin owners? It’s tiny. Yet another bear whale to slay.

Second, the defunct Mt. Gox exchange started repaying creditors, which means roughly $9 billion worth of Bitcoin is being returned to them.

Of this amount, $8.2 billion is in Bitcoin, and there is the fear that majority of creditors are likely to sell it, adding to the selling pressure. They’re afraid of a Bitcoin price crash.

Buying opportunity?

Despite these pressures, there’s some good news. The amount of Bitcoin held on exchanges seemingly decreasing since 2021 and is now at a multi-year low. Or at least, this is one of the most common views.

Next to this, data shows that Bitcoin miners have exhausted their reserves, meaning they’re less likely to sell more Bitcoin at this point.

Also more and more fund investors have been buying Bitcoin during its recent dip, marking the strongest weekly performance for Bitcoin funds in over a month.

This could means that at least some investors are taking advantage of the lower prices to increase their holdings.