It’s okay to hate the Danish government, but not because they want to banning Bitcoin wallets. They officially announced they don’t want that.

No banning

Last week, the rumor started to develop that in Denmark they want to ban the self-custodial Bitcoin wallets, making high buzz in the social media.

Shortly after that, the Danish Financial Supervisory Authority made it clear there are no plans to ban self-custodial cryptocurrency wallets.

Tobias Thygesen, director of fintech, payment services, and governance at the DFSA, stated that the regulator has no intention of banning hardware wallets or any other non-custodial wallets.

“We are aware of some misinformation circulating on social media suggesting that the DFSA intends to ban hardware wallets and other non-custodial wallets.”

Misinterpreted clarifications are still clarifications?

The rumors likely started due to confusion surrounding the newest regulatory assessment related to Europe’s Markets in Crypto-Assets, the infamous MiCA Regulation. MiCA, which took effect on June 30.

It sparked pretty much discussion and confusion. The DFSA’s assessment, published on June 25, was meant to clarify challenges in regulating crypto services, but some people misinterpreted the content, leading to false information spreading.

They’re here to help

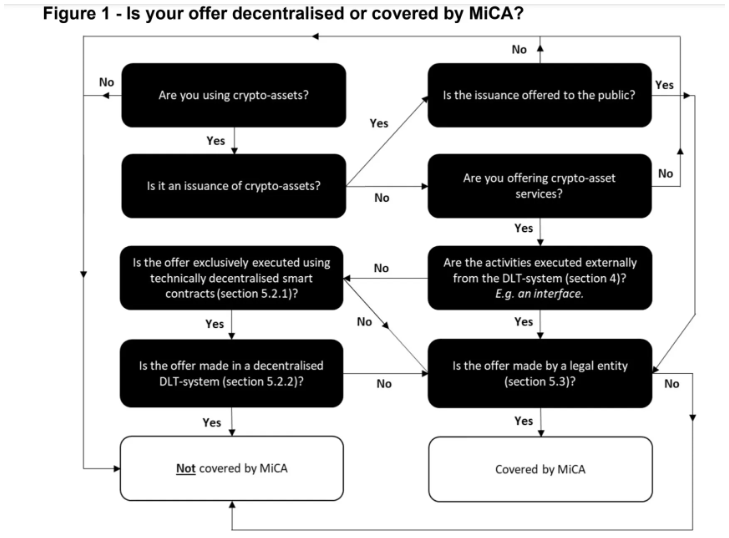

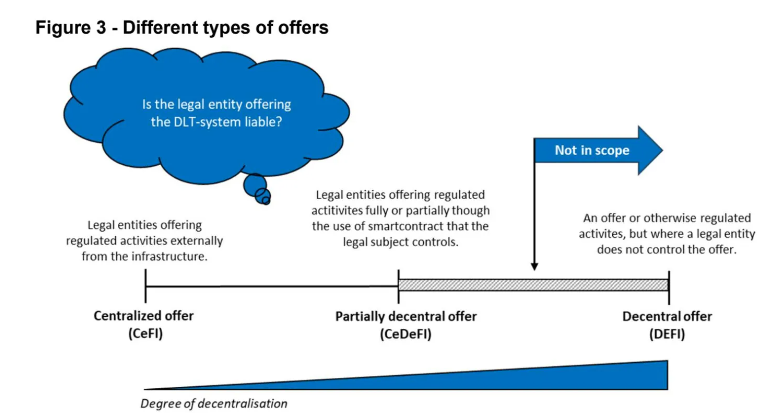

The DFSA’s paper outlined a few principles to help people understand when their services are truly decentralized, or just decentralized in name only, while they’re permissioned.

A fully decentralized offering isn’t subject to MiCA regulation and doesn’t need a license. Bitcoin is fully decentralized, this is why they don’t regulate it, not because they don’t want, but because they can’t.

By the end of 2024, new rules will regulate Denmark’s crypto market, more specifically the participants of the crypto industry, including issuers and service providers, all the centralized companies. But services that are fully decentralized won’t be covered by these rules.

Thygesen told that these guidelines, principles can help actors determine if their offerings are fully decentralized. Misclassifying could result in providing services unlawfully.