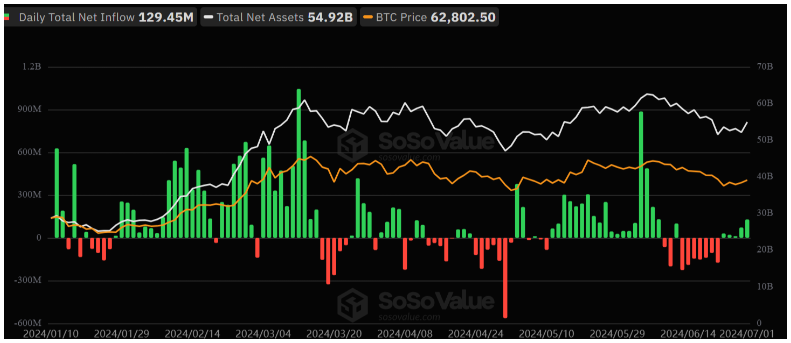

Bitcoin ETFs in the U.S. have seen their highest inflows in a month, with Bitcoin’s price approaching $63,000. Finally, some good news!

Where are my inflows?

Spot Bitcoin exchange-traded funds in the United States experienced nice inflows of $129.45 million on July 1.

This means we got the fifth consecutive day of positive inflows for these ETFs.

Since their approval on January 10, major ETF issuers have seen large inflows and trading volumes.

Except the GBTC, the Grayscale Bitcoin Trust, which has had almost zero inflows and only got outflows since its conversion to an ETF.

Fidelity wins

The $129.45 million inflow on July 1 is the highest since June 7. With these positive inflows, Bitcoin’s price recovered to $63,000 after struggling to break past the $62,000 resistance level for nearly three weeks.

Data from crypto research platform SoSo Value shows that Fidelity’s Wise Origin Bitcoin Fund led with an inflow of 1,030 BTC worth $65 million.

The Bitwise Bitcoin ETF followed with 650 BTC worth $41 million.

The ARK 21Shares Bitcoin ETF saw inflows of 205 BTC worth $13 million. On the same day, BlackRock’s iShares Bitcoin Trust and GBTC recorded no inflows. Pretty surprising, but it is, what it is.

The summer season, especially July has historically been a bullish month for Bitcoin. But not now.

In this year, June was bearish for both Bitcoin ETFs and BTC prices, with more outflow days than inflow days and higher value outflows.

The bullish trend for Bitcoin ETFs on July 1 coincided with a surge in BTC price, hitting a weekly high of $63,778.

Despite this, Bitcoin dipped below $63,000 on June 2, trading at $62,500 at the time of writing.

Bitcoin has recovered from its weekly low below $60,000, it remains over 15% down from its all-time high of $73,750 in March.

Have you read it yet? GameStop memeking Roaring Kitty faces lawsuit

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.