A fresh, but recycled debate emerged regarding the importance of Bitcoin exchange balances, as 140,000 BTC from the Mt. Gox incident are set to be released soon.

Got Bitcoin?

Bitcoin exchange balances are at their lowest in six years, which has traditionally been seen as a good sign, a sign of the increasing demand.

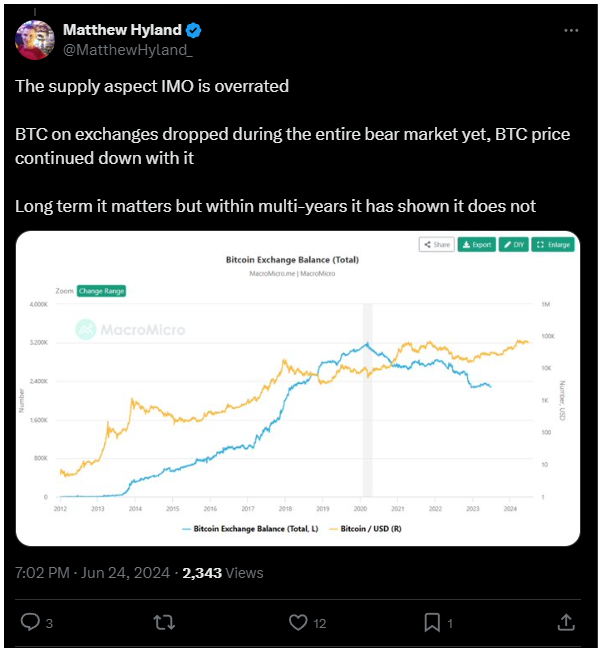

But popular commentator Matthew Hyland recently challenged this notion.

In a post on X, Hyland argued that the correlation between exchange supply and Bitcoin price is overstated.

He noted that while Bitcoin on exchanges decreased during the entire bear market, the price of Bitcoin continued to fall, suggesting that the supply aspect is probably overrated in the short term.

Low supply

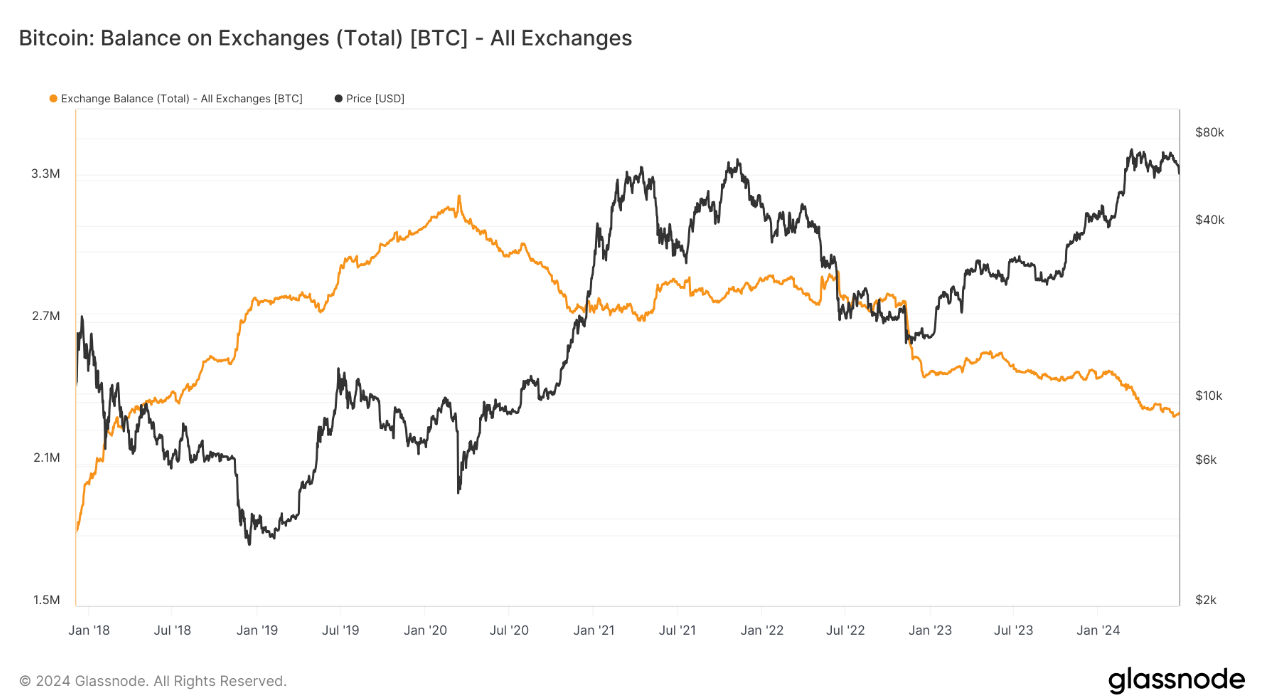

According to Glassnode, an on-chain analytics firm, the total Bitcoin available for purchase on major trading platforms is currently 2,317,495 BTC.

This figure marks a multiyear low, with a decrease of approximately 18,000 BTC over the past two weeks.

The last time exchanges held such a small amount of BTC was in March 2018.

Of course, the crypto community speculate that this low supply shows strong holding sentiment among investors, yet some analysts, like Hyland, believe that this doesn’t necessarily means price strength.

Flooding the market

Now the situation is complicated by the coming release of 140,000 BTC from the now-defunct exchange Mt. Gox.

The bankruptcy proceedings are expected to happen in July, with these funds being returned to the users.

There is a divide in opinion on whether this will lead to a mass distribution event that could impact the market.

Popular trader Bob Loukas suggested that the release of these funds wouldn’t be positive for the market.

It can’t be positive that’s for sure.

— Bob Loukas 🗽 (@BobLoukas) June 24, 2024

Conversely, Samson Mow, CEO of Bitcoin adoption firm Jan3, believes that fears about a massive sell-off are overblown.

He argued that the current dip in Bitcoin’s price is driven by sentiment and fear, not by the actual selling of large holdings.

He also speculated that even if Mt. Gox coins come to market, they will likely be sold via over-the-counter channels, which would minimize their impact on the market price.