FTX creditors will soon vote on if they want their recovered funds in cash or cryptocurrency, as a court ruling allowing FTX to offer this choice to them.

Return of the funds

U.S. Bankruptcy Judge John Dorsey approved FTX’s plan to ask creditors if they prefer cash payments or crypto at its current market price, for their compensation. So now, they have to vote.

Before this, many creditors expressed concerns with FTX’s proposed, original liquidation plan what they shared in May.

This plan offered a 118% return for 98% of victims if their claims are under $50,000, based on asset prices from November 2022 when FTX filed for bankruptcy.

Some creditors prefer to receive their repayments in cryptocurrency, based on their previous on-site balance, reflecting the 165% increase in the crypto market’s total market cap since FTX’s collapse.

For example, Bitcoin’s price has surged from about $16,900 at the time of the bankruptcy to $61,770 at present, so it’s more than three times bigger.

This explains why some creditors aren’t want to accept cash payments, because they feeling shortchanged – and they’re – compared to these nice gains if paid in crypto.

People vote, court decide

FTX’s lawyer Andy Dietderich explained that the vote’s goal to gather input from the many FTX customers who haven’t yet participated in the repayment talks.

But despite this, FTX lawyers told that bankruptcy laws require valuing claims based on the filing date, aligning with their current plan.

Lawyers noted that the cash repayment plan would be simpler to execute and wouldn’t subject creditors to capital gains tax.

Even if creditors vote for crypto repayments, the court isn’t obligated to approve this preference, it can decide in favor of cash.

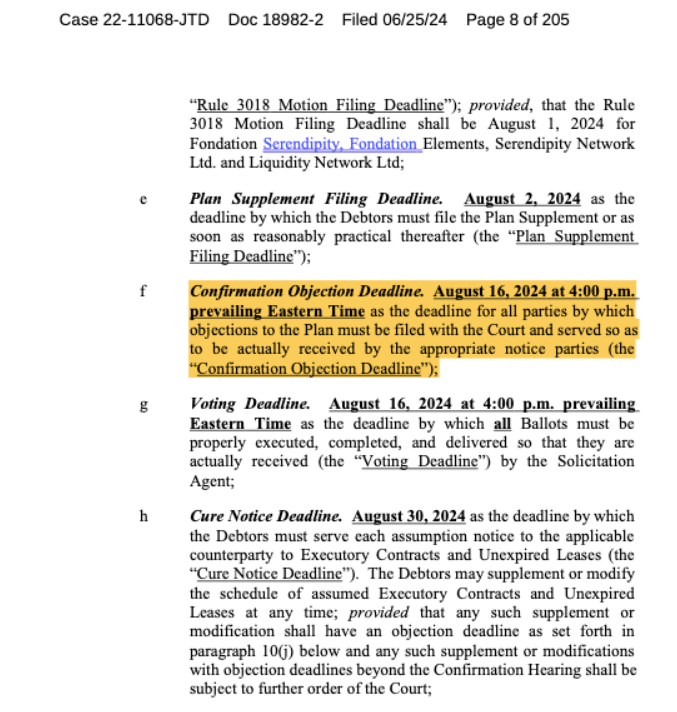

Creditors have time until August 16 to vote, and Judge Dorsey will decide on the approval on October.

Not your keys, not your Bitcoin

Since filing for bankruptcy, FTX has recovered $11.4 billion in cash, with expectations to reach $12.6 billion by end of October, when FTX’s Chapter 11 plan might take effect.

FTX was one of the largest crypto exchanges before its collapse in November 2022, where about $8 billion in customer funds were misappropriated, largely by FTX’s trading firm Alameda Research.

This misuse led to a liquidity crisis, and the exchange became insolvent.

Former CEO Sam Bankman-Fried faced several fraud and money laundering charges, leading to a 25-year prison sentence in March 2023 after being convicted in November 2023.

Have you read it yet? Possible XRP adoption in Thailand

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.