While the market’s panicing over the Bitcoin crash, large investors have quietly been buying nice amounts of the cryptocurrency. Speaking about buying the dip.

Big. Whales. Buying.

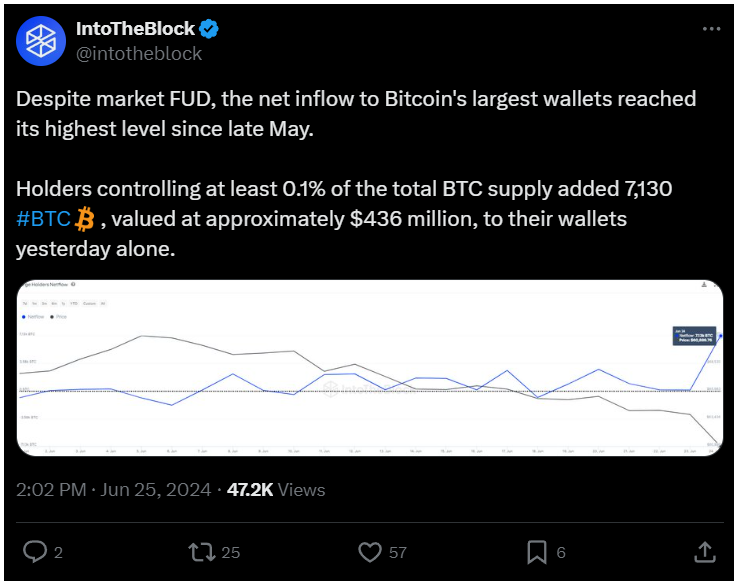

An on-chain indicator called Large Holders Netflow tracks the net amount of Bitcoin entering or exiting the wallets of these investors.

According to IntoTheBlock, Large Holders are those who own at least 0.1% of the total circulating supply of Bitcoin, which is now about 19,700 BTC.

These aren’t simple whales, but mega-whales. With Bitcoin’s current price, this amount is worth over $1.2 billion, meaning that these investors have substantial market influence.

Data shows that the Large Holders Netflow has been positive, meaning these investors have been receiving more Bitcoin than they have been sending out.

Pure accumulation signal. And all while the market is supposedly in a bearish phase. You sure?

When you want to buying the dip, and you have half a billion on hand

During the market downturn, where Bitcoin’s price fell below $60,000, these large investors took the opportunity to buy more, and they accumulated a net amount of 7,130 BTC, worth around $439 million at current prices.

This strong buying activity means that these whales see the recent price dip as a good chance to accumulate more Bitcoin, despite widespread fear and uncertainty among smaller players in the market.

Zoom out

In the social media many speculate that the actions of these Large Holders prove a belief that the current low prices are temporary and present a profitable opportunity for future gains. Because the majority hopes gains are coming.

In addition to the big purchases by Large Holders, another positive development for Bitcoin happened.

According to the IntoTheBlock, there have been large inflows of USD Coin into exchanges earlier this week, and this may means they want to buy, which could potentially boost the price.

USDC net inflows into centralized exchanges hit a one-year high yesterday of $228M

People depositing stables to buy the dip? $BTC $ETH pic.twitter.com/oAwDv4O1dX

— Lucas (@LucasOutumuro) June 25, 2024