Metaplanet wants to issue 1 billion yen in bonds to purchase Bitcoin, increasing its holdings to 241 Bitcoin, worth about $15 million. The MicroStrategy method at its finest.

Borrow fiat to buy Bitcoin

Tokyo-based Metaplanet, an investment and consulting firm, announced its plan to issue 1 billion yen apx. $6.26 million in bonds to fund a new round of Bitcoin purchases.

The company’s board approved the move, noting that the Bitcoin would be held long-term, as reserve asset, not for trading.

The bonds will offer an annual return rate of 0.5%. If Bitcoin’s price rises more than 0.5% each year, and basically every single experts agree it likely will, Metaplanet will bagging a nice profit.

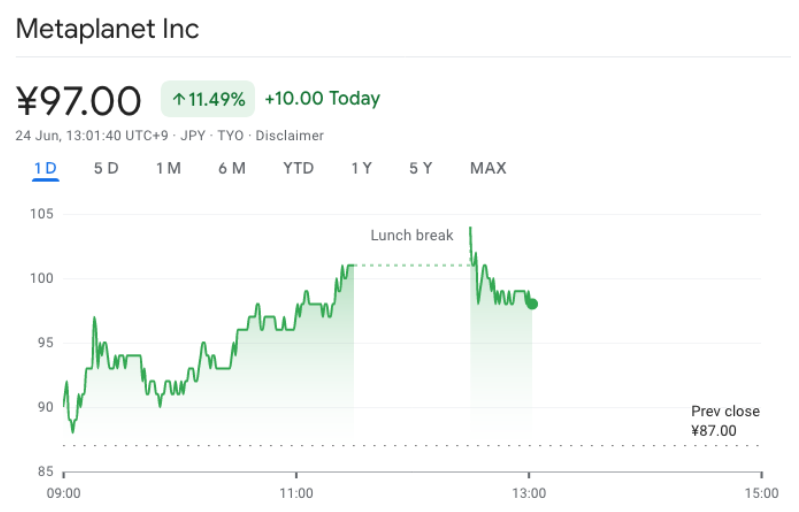

On June 24, Metaplanet’s shares increased by 11.5% to 96 yen ($0.60), continuing a mindblowing 500% rise this year.

Slowly but steady

Bitcoin recently hit a 40-day low, dropping 2.6% to $62,733 after nearing $72,000 in early June, as reported by CoinGecko.

If Metaplanet buys Bitcoin with the bond proceeds now, they would acquire nearly 100 BTC.

This purchase would add to their current holdings of 141.07 BTC, boosted by a recent acquisition of 23.25 BTC on June 11.

In first sight this may seem small, but 241 BTC is likely more than any other public Japanese company holds. By 241.

Nothing stop this train

Metaplanet initially bought 117 BTC in mid-May, adopting a “Bitcoin-first, Bitcoin-only approach” due to economic pressures in Japan.

Their average purchase price was 10.28 million yen ($65,365) per Bitcoin, so the current prices mean they are slightly underwater on their investment strategy, but this doesn’t matter on long term.

Comparisons have been made to MicroStrategy, a U.S. company with the most Bitcoin holdings at 214,400 BTC worth $13.4 billion, and Metaplanet’s stack is undeniably smaller.

But they’re entered the big boys’ league, because they purchased.

The game theory is inbuilt into the Bitcoin protocol, both for the price and for adoption. Now we see the biggest asset management corporations investing in Bitcoin, and countries adopting it as legal tender, so it’s fair to assume Bitcoin will stay.

This means the earlier someone jumps on the train, the bigger the win. And they’re starting to realize this.