Raydium, a decentralized exchange on the Solana network outpaced Uniswap in daily trading volumes in last week, making it a major hub for cryptocurrency activity. And making history.

The first blood

Raydium saw its 24-hour trading volume hit $822 million, a milestone-figure though still lower compared to centralized exchanges.

But Uniswap V2 has about $192 million in daily trades, while Uniswap V3 sees around $633 million, and despite Uniswap’s multiple versions contributing to its total volume, Raydium has managed to deliver this trading activity within a single platform.

This is not common, of course. Raydium experiences around $400 million in daily trades, driven by its on-chain order book that supports high-speed transactions.

The Solana network usually has been able to handle most of this traffic, but there is a 20-25% transaction failure rate, which is not small at all.

Still, Uniswap is the unspoken king of dexes, and now there is a worthy opponent in the ring.

Traders, and degens, and probably degen traders

Raydium’s activity consists of two main types, there aren’t just traders and degens. One involves projects that longing for high social media engagement, setting high expectations before listing. In plain English: they want to create hype, as big as possible.

The other type includes tokens that launch pools with small amounts of 3-6 SOL, trying to attract automated traders who hope for quick gains.

A notable boost in activity was due to the launch of Daddy Tate (DADDY), a token associated with influencer Andrew Tate.

In the past three days, the SOL/DADDY trading pair accounted for 22% of Raydium’s bot-driven volume.

Trading pairs on Raydium can change rapidly, with only a few meme tokens maintaining long-term activity.

Volume up, token down

Raydium now handles 50% of all trading volume on the Solana network, comparable to Uniswap’s share of dex volumes across different networks.

The bots contribute to Raydium’s volume, organic trades still make up 30% of Solana’s dex activity.

So niw Raydium is the fourth-largest DeFi protocol on Solana, with over $900 million in total value locked, surpassing even the Jupiter dex aggregator.

The value on Raydium is more than four times that of Orca, another popular Solana exchange.

Raydium leads with over 427,000 daily transactions, far surpassing the Serum dex, which sees around 50,000 transactions.

Despite this, the RAY token hasn’t yet reached its peak from the 2021 DeFi craze, down from its high of over $16.

Have you read it yet? SEC’s Ethereum investigation is over, but what about other blockchains?

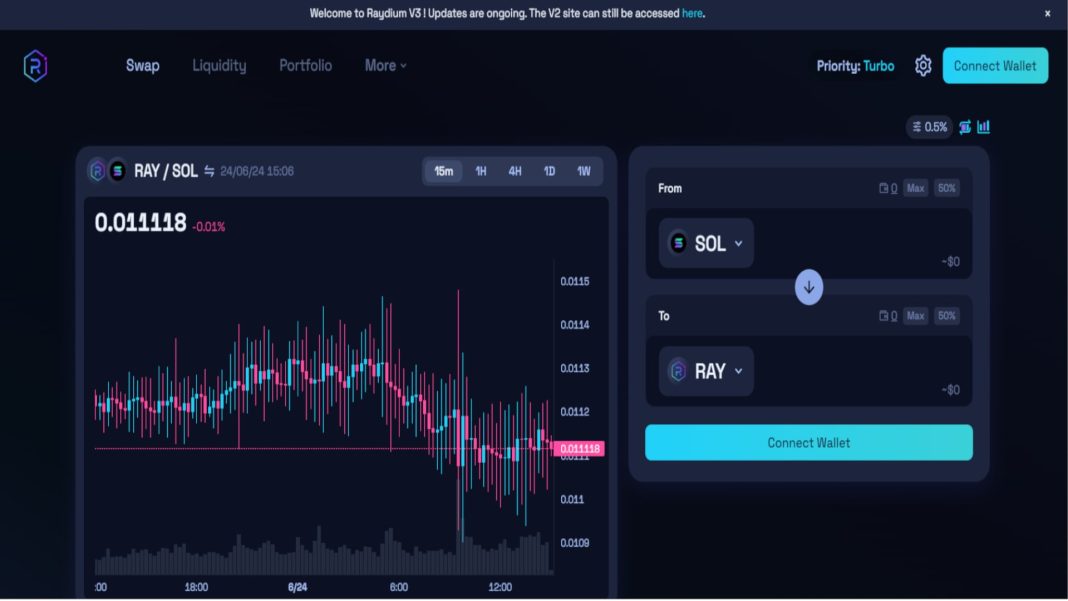

featured image: screenshot Raydium

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.