A well-known crypto analyst, Miles Deutscher has identified a fundamental problem causing altcoins to lag in the current market cycle.

The floodgates are open

Deutscher explained his findings in a series of posts on X, and shared he believes the main issue is the massive influx of venture capital, the seemingly unlimited funding into the crypto market, particularly from 2021.

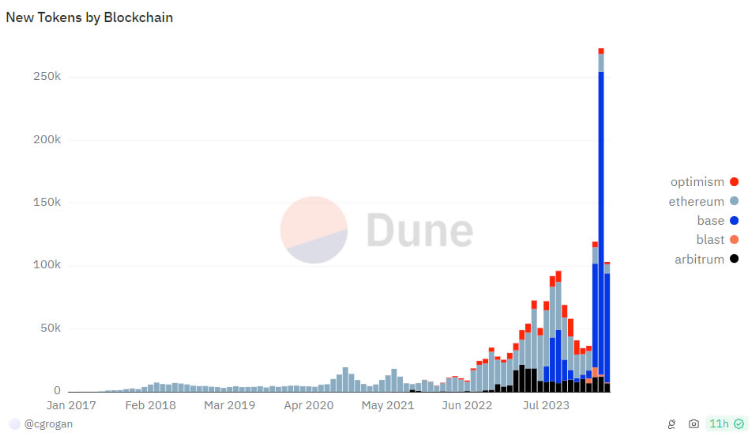

This surge of funding led to a huge increase in new projects, with the total number of tokens tripling between 2021 and 2022.

Many of these projects delayed their launches during the bear market, as starting a new project in such conditions is often doomed to fail, but when the market recovered in late 2023, these delayed projects, along with many new ones, flooded the market.

Very few buyers, but lot of new supply. Every day.

Deutscher’s findings shows that over 1 million new crypto tokens have been launched since April alone, and this giant number of new projects has led to what he calls altcoin dispersion, similar to inflation in traditional economies.

He explains that creating more tokens reduces the purchasing power of crypto compared to other currencies like the US dollar.

Right now, there is about $150 million to $200 million of new supply issued daily due to token unlocks and new launches.

This level of selling pressure is unprecedented in the market, and combined with insufficient new liquidity, aka willing buyers with deep enough pockets, has caused altcoins to perform poorly compared to Bitcoin.

Deutscher believes changes are needed from exchanges, project teams, and VCs to address this issue.

Mr. Gainzy didn’t come

The analyst also warns that retail investors are losing faith in the market, as there is a bull market, allegedly, but prices are stagnant.

He also points out that the skew towards private market investments is one of the biggest problems in crypto, making it hard for retail investors to succeed.

Many new projects launch with high market caps, leaving little room for price growth, and private investors gradually selling their locked tokens drains capital.

Despite these challenges, Deutscher is optimistic about the crypto market’s future, as he believes the market will eventually correct itself and become more favorable for retail investors.

But we can ask how many will lost a considerable amount of money until that, and how big will be the loss?

Have you read it yet? Bitcoin mining industry is on fire

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.