Over the last weekend, the Shibarium network experienced a nice spike in transactions, and we got a 441% rise on Saturday.

The data shows that transaction count literally skyrocketed, reaching over 13,190 on Saturday, up from under 3,500 earlier in the week.

Looks nice, but still far from the records

This rise led to higher fees on the network as it struggled to handle the increased activity, and the average transaction fees paid in BONE, Shibarium’s native token, saw a 176% jump.

While these numbers might seem small compared to earlier this year, they come during a really bearish period for the Shiba Inu community.

The increase in transactions is a positive sign for SHIB’s price, as more transactions mean more gas fees, leading to more SHIB tokens being burned.

This deflation could boost the token’s value in the long term, or at least, this is the common hope among the holders.

Bad dog

The token has been on a decline for the past weeks, losing 13.11% of its market cap due to a market-wide downturn led by Bitcoin, and now SHIB is hovering around the $0.000020 price level and many think it might fall further, despite the recent surge in Shibarium transactions.

According to IntoTheBlock, around 3.97 trillion SHIB tokens bought by 5,270 addresses act as resistance at this level, but if SHIB breaks below this support, the next key level is at $0.000190, where 4,310 addresses hold 6.21 trillion SHIB tokens.

Aidrop? Asking for a friend.

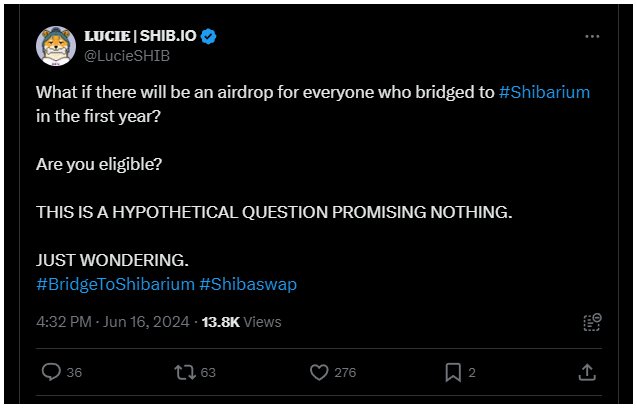

Lucie, Shiba Inu’s marketing lead hinted at a potential airdrop for those who bridged to Shibarium within the first year, causing excitement among Shiba Inu fans.

Later she clarified that this was a hypothetical scenario and not a guaranteed event, stating on social media platform X.

Experts think this spike in activity on Shibarium signals growing interest and usage, which could bode well for SHIB’s future price, despite current market issues.

Have you read it yet? Based on indicators, $127K Bitcoin price may coming

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.