Bitcoin has been facing downward pressure despite large purchases by spot exchange-traded funds. An analyst explains the reasons behind this trend.

Investors buying AND selling

In a recent thread on X, analyst Willy Woo discussed why Bitcoin’s price has been falling despite buying pressure from spot ETFs and institutional investors.

He pointed out that long-term holders, who typically keep their coins dormant for long periods, have been selling.

These holders rarely sell, and their selling usually follows a historical pattern. And now it’s time.

Woo used the so-called Coin Days Destroyed (CDD) metric to illustrate this trend, where the CDD measures the number of coins moved on the network daily and weighs it against the age of these coins.

A spike in CDD indicates that many dormant coins have been moved. Earlier this year, Bitcoin’s CDD spiked when the price hit a new all-time high, suggesting that long-term holders sold a big chunk of their coins during the rally.

Similar spikes were seen during the bull runs of 2017 and 2021 too, and Woo think this pattern shows that the recent selloff from long-term holders is consistent with past behavior.

Paper Bitcoin sounds like fractional reserve banking

Another factor contributing to Bitcoin’s recent price struggles is the thing what we call paper Bitcoin.

Paper Bitcoin refers to derivative products that don’t involve actual ownership of the cryptocurrency.

Woo explained that in the past, Bitcoin prices would rise rapidly because the only sellers were early adopters and a small number of miners selling newly mined coins, and trading happend with actual, real Bitcoin transfers.

Now it’s different. Today, paper Bitcoin has a significant influence on the market.

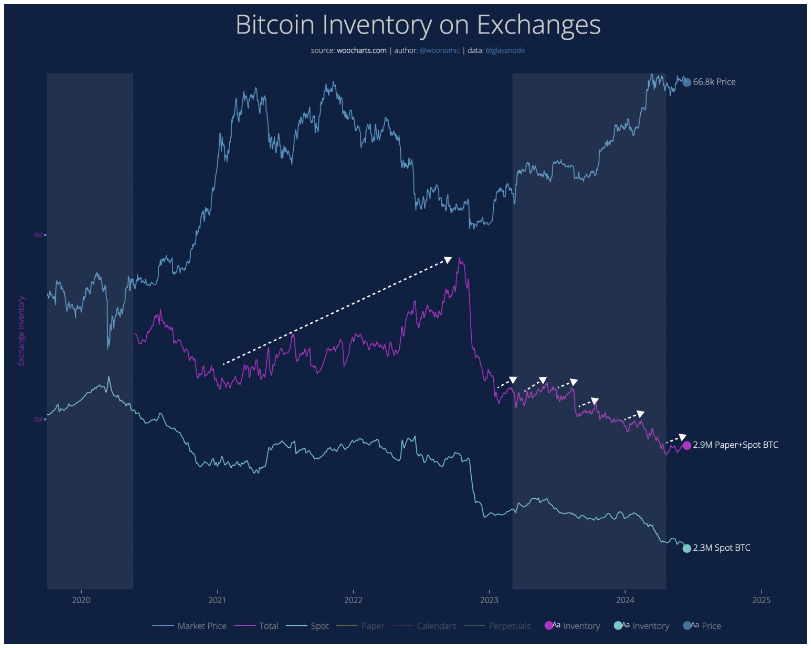

The spot inventory of Bitcoin has shown only downward and sideways trends in recent years, indicating that exchanges haven’t seen substantial net deposits.

But during the 2022 bear market, the combined inventory of spot and paper Bitcoin increased, suggesting that paper Bitcoin was being created rapidly while spot inventory remained stable.

Woo pointed out that this increase in paper Bitcoin was a key factor in the bear market.

History rhymes

During the current bull market, whenever the inventory of paper Bitcoin has risen, Bitcoin’s rally has slowed, and now we see this again, the inventory of paper Bitcoin has been increasing again, which might explain why Bitcoin has struggled to maintain bullish momentum.

The selling behavior of long-term holders and the rise of paper Bitcoin are not new phenomena, as long-term holders have historically sold during price peaks, and the influence of paper Bitcoin has grown over time.

One can speculate that if the trend of increasing paper Bitcoin continues, it may continue to suppress Bitcoin’s price.