Bitcoin’s price has been stuck between $65,500 and $67,000, leaving investors unsure of where the market is headed.

Many expected a bull run to kick off right after the Bitcoin halving event in April 2024. It didn’t happen. Are we f*cked now?

When will Bitcoin hit its peak?

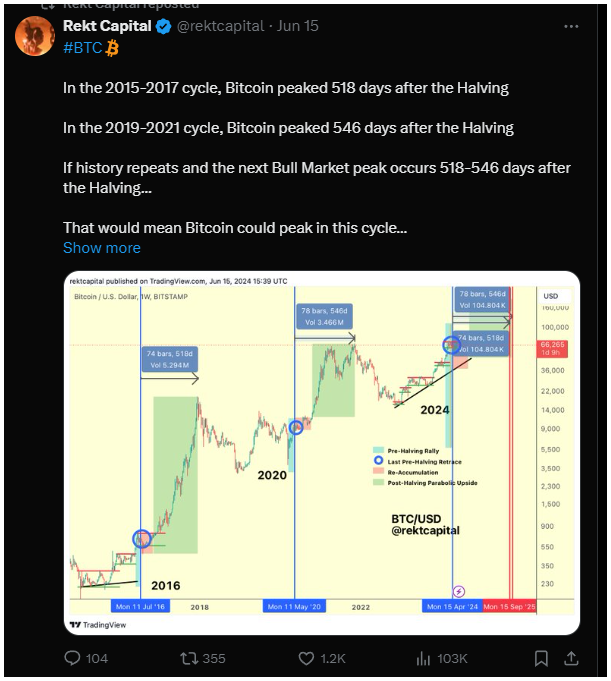

Based on historical patterns, popular social media analyst Rekt Capital believes Bitcoin could peak sometime between mid-September and mid-October 2025, and this prediction is based on when Bitcoin reached its peak in previous halving cycles.

In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving. Similarly, the peak in the 2019-2021 cycle occurred 546 days after.

Following this trend, Rekt Capital suggests a similar timeframe for the current cycle, but unfortunately, that’s more than a year from now.

This time is different?

While past data is helpful, Rekt Capital also highlights that the current cycle is moving faster than expected, about 170 days ahead of previous cycles, but there is the famous – or infamous – Saylor saying, as all our models will be destroyed.

This faster pace makes it harder to pinpoint when Bitcoin might actually peak this time around. In plain English: we don’t know.

I bought the dip, but it keeps dipping

Rekt Capital suggests that experienced investors know when to buy and when to sell, and now the analysis hints that current selling might lead to a short-term price increase for Bitcoin, followed by a steeper drop, potentially causing a market crash.

Currently, Bitcoin’s price is falling after a brief climb to $68,000. It’s now back down to around $65,650, failing to break above $70,000 again. In time of writing. In time of reading, you may know more.

Have you read it yet? Can USDT face regulatory blocks in the EU?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.