Recent data reveals that Bitcoin (BTC) whales have been quietly buying while the market shows signs of panic, with a nice amount of Bitcoin being withdrawn from exchanges.

Hardcore bitcoiners says don’t sell your coins to the whales!

This Bitcoin is not for sale

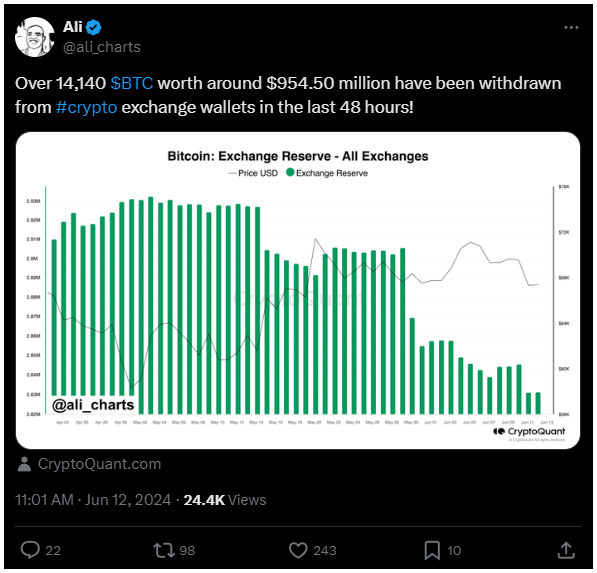

According to well known crypto analyst, Ali Martinez, there have been an uptick in Bitcoin withdrawals from exchanges in the past few days.

The metric of interest, the Exchange Reserve, tracks the total Bitcoin held in the wallets of all centralized exchanges, and when this number rises, it suggests that more Bitcoin is being deposited into exchanges, often for selling.

Conversely, a decline means that users are withdrawing Bitcoin from these platforms, as they don’t want to sell, which can be a bullish sign as it suggests holders are moving their coins to long-term storage.

Self-custody and accumulation

The numbers are clear, the Exchange Reserve has decreased. Around 14,140 BTC, worth roughly $954 million, has been withdrawn from exchanges in the last few days, and because this period coincides with Bitcoin trading at lower prices, analysts suggests that these withdrawals might represent accumulation at these lower price points.

The scale of these transactions implies that whale investors, who hold large amounts of Bitcoin, could be involved.

Likely MicroStrategy, BlackRock, and the others. Their decision to move coins to self-custody can be a positive indicator for Bitcoin’s future performance, or at least, this is one of the most common views among marker analysts.

Number go up. We just have to wait?

Following these withdrawals, Bitcoin’s price has rebounded, climbing back above $69,000 for a short time.

This recovery suggests that the recent accumulation by whales might already be having a positive effect, even if it isn’t too long.

And worth to mention the Exchange Reserve has been declining steadily over the past month, signaling a clear trend of taking coins off exchanges.

This trend shows a growing interest in holding Bitcoin long-term. Bitcoin’s recent price movements could reflect the impact of these activities.

The price has rebounded to $69,300 before it it stopped climbing, it remains within the range it has been stuck in for some time.

One can speculate that if the trend of withdrawals continues, it could signal increasing confidence among large investors, potentially leading to more positive price increases in the future.