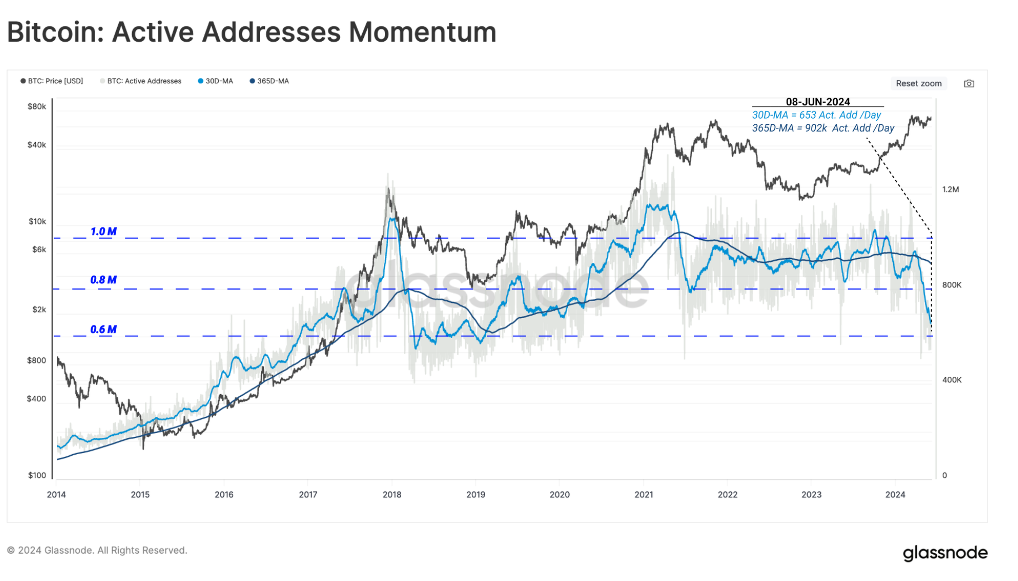

Bitcoin’s network activity is showing an interesting trend, as while the number of transactions is at an all-time high, the number of active addresses has dropped big time.

Less users, more transactions

Glassnode’s latest weekly report reveals this pretty unusual pattern.

Active addresses, which represent the unique number of addresses involved in transactions daily, have decreased in the recent months.

Typically, this number rises during bullish market phases, indicating more users participating. But this time, the trend is different. It’s decresing

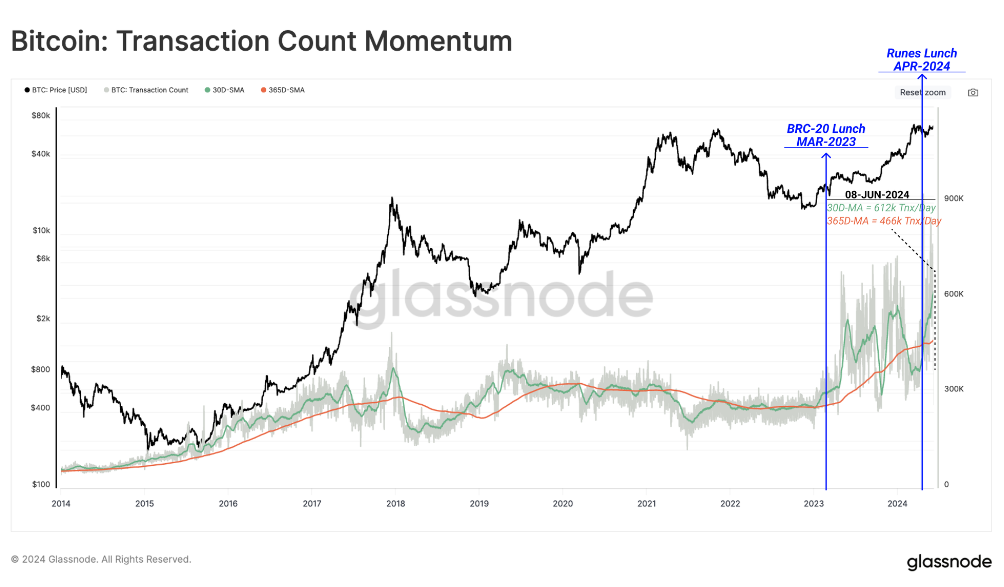

Active addresses have been declining, even though the transaction count has surged. The 30-day moving average for transactions is around 612,000 per day, near the all-time high.

This suggests that although fewer addresses are active, each is conducting more transactions.

Development is good?

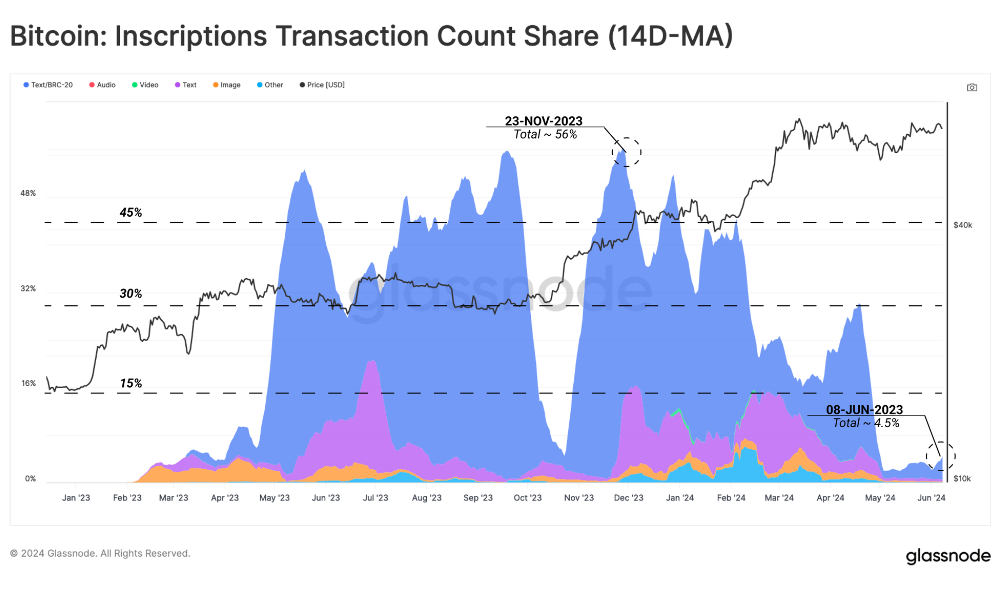

Many thinks, including the Glassnode’s analysts, the difference might be linked to Bitcoin Inscriptions.

These allow users to inscribe data onto Satoshis, Bitcoin’s smallest unit, creating non-fungible tokens, like the NFTs on other networks.

While popular earlier this year, Inscriptions faced heavy criticism for being spammy and reducing network usability.

The decline in active addresses aligns with a drop in Inscription transactions starting mid-April, around the Halving.

This timing coincides with the launch of the Runes protocol, which enables fungible tokens on the network through a different method than Inscriptions.

The Runes protocol’s introduction around the fourth Halving likely contributed to the fall of Inscriptions.

The world is changing, so Bitcoin

This shift indicates a changing trends in Bitcoin transactions, where new protocols and user behaviors are altering the network’s activity.

Bitcoin’s transaction dynamics are changing, influenced by new technologies, new projects and market trends.

While fewer addresses are active, the increase in transactions highlights new phenomens in user activity.