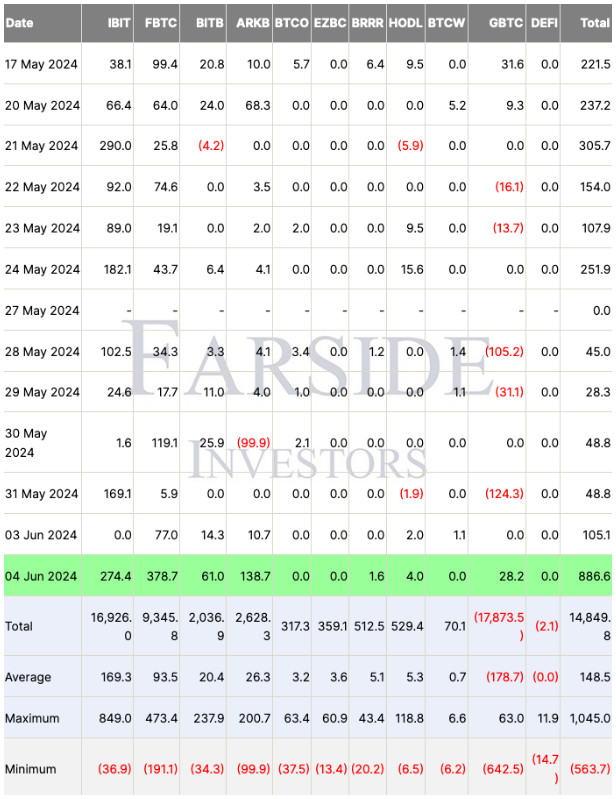

The recent surge saw US-based spot Bitcoin ETFs collectively received a humble $886.6 million in net inflows, in a single day.

Fidelity’s Wise Origin Bitcoin Fund, the FBTC topped the charts with $378.7 million, but BlackRock’s IBIT following closely, with $274.4 million.

378 million reasons to win

Fidelity’s Bitcoin fund emerged as the leader, with substantial inflows of $378.7 million on a day, which became the second-highest net inflow day for US spot Bitcoin ETFs.

After the second place, which now belong to the BlackRock, the ARK 21Shares Bitcoin ETF secured the third spot with $138.7 million in net inflows.

This is the biggest inflow since March 12, which witnessed a record-breaking $1.04 billion, coinciding with Bitcoin reaching an all-time high of $73,679 on March 13.

The giant inflows proving a strong market interest in Bitcoin ETFs, challenging skeptics who doubted the demand.

We can assume despite the volatility and mixed market sentiments, this amount of inflows suggest a growing confidence among both institutional and retail investors in these financial instruments, and this confidence could signify a broader acceptance of Bitcoin as a viable investment asset, or at least, the majority hoping so.

Sleeping giant

Grayscale Bitcoin Trust experienced a rare influx, drawing in $28.2 million. This marks only the seventh inflow day since its transition from a closed-end fund to a spot ETF in January.

They experienced over $17.8 billion in net outflows due to high management fees and narrowed discounts, this recent inflow reflects a possible shift in investor sentiment.

In the beginning, GBTC held 620,000 BTC, but this has now decreased to 285,481 BTC, valued at $20.2 billion.

Bitcoin is a fringe asset they said. No one interested they said.

ETF Store president Nate Geraci responded to Bitcoin critics on social media, highlighting the undeniable demand for Bitcoin ETFs, contrary to earlier predictions.

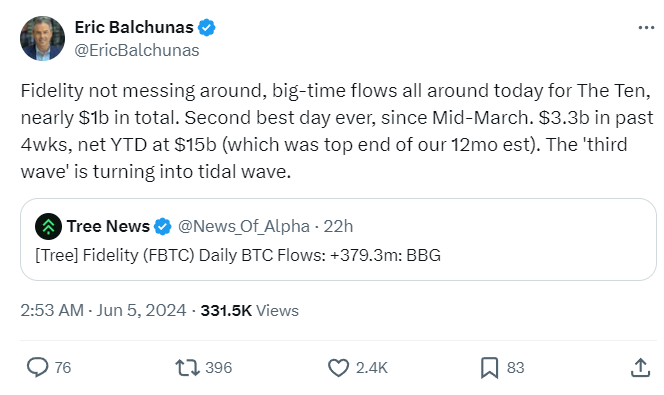

Bloomberg ETF analyst Eric Balchunas also noted the inflows, and also mentioned the strong market activity.

Of course, not all Bitcoin ETFs shared this success. Invesco Galaxy, Franklin Templeton, WisdomTree, and Hashdex didn’t record any inflows on the same day, on June 4.

The surge in Bitcoin ETF inflows could have serious implications.

It suggests, or more like prove an increasing institutional interest in Bitcoin, which might drive more investment and stability in the whole cryptocurrency market.

The significant inflows to leading ETFs like Fidelity and BlackRock could also indicate a shift towards more regulated and secure investment vehicles within the crypto space.