Bitfarms has dismissed Riot Platforms’ takeover bid, arguing that it undervalues the Canadian crypto miner, and revealed it had received other expressions of interest as well.

Being the biggest isn’t cheap

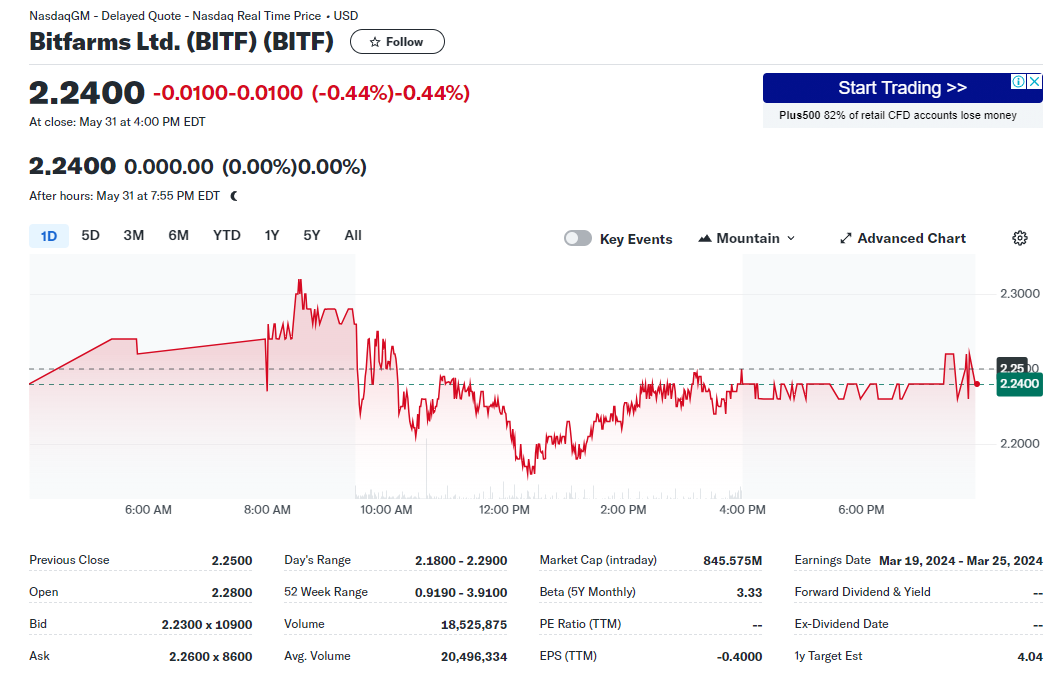

Riot’s proposal, offering $2.30 per share, was intended to create the world’s largest bitcoin mining company.

Bitfarms deemed the offer unacceptable and claimed that Riot failed to respond to their request for standard confidentiality and non-solicitation agreements.

The board’s committee determined that Riot’s proposal underestimated Bitfarms’ value and growth potential.

Shortly after this, Bitfarms has enlisted investment bank Moelis as its financial adviser.

The market reacted well tot he news, BITF shares increased by nearly 5% to $2.31 in early trading on Wednesday.

The bitcoin mining industry is booming

The bitcoin mining sector has seen huge advancements, likened to an arms race where participants must continuously upgrade their equipment to maintain their competitiveness.

The network hashrate, representing the total computational power of miners, frequently sets new records, while mining difficulty is near its all-time high.

This prove the long-term commitment of miners, given the low return on investment typically associated with mining operations.

There are also other important changes on the field, as the involvement of nation-states like El Salvador and Bhutan in bitcoin mining shows a big shift.

These countries are mining bitcoin for their reserves, prompting experts to predict a new phase in bitcoin’s game theory.

Nothing stop this train

As individuals, corporations, and even sovereign nations recognize the potential risk of being left behind, there is an increasing urgency to participate.

The endorsement of bitcoin by major investment firms through bitcoin ETFs also indicates that bitcoin is here to stay, contrary to some mainstream media narratives that suggest it is a passing fad.

This growing competition in bitcoin mining highlights the strong confidence in the cryptocurrency’s future, as the massive continual investment in mining infrastructure and the entry of powerful new players suggest the long-term viability of bitcoin.