The Ethereum market is witnessing a huge shift, with a spike in the number of small investors holding less than 10 ETH.

This surge in retail interest coincides with a recent rise in Ethereum’s price and growing speculation about the approval of Spot Ether ETFs by the SEC.

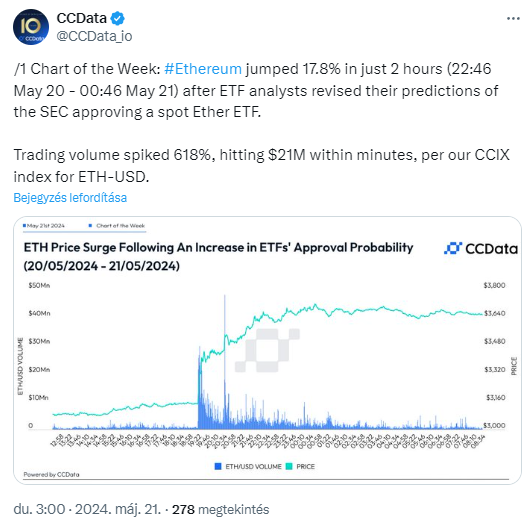

ETF Speculation

The number of small Ethereum holders has reached a record high, while larger investors have reduced their holdings compared to the start of the year.

This trend is likely driven by Ethereum’s recent price increase, which has made it more attractive to smaller investors.

Additionally, the anticipation surrounding the potential approval of Spot Ether ETFs by the SEC has fueled retail interest, as many see it as a signal of future price appreciation.

The SEC’s request for updated filings from exchanges regarding Spot Ether ETFs has sparked speculation that approval might be on the horizon, sooner than we may think.

While the exact reasons behind the SEC’s request remain unclear, it suggests that the regulatory body may be leaning towards approving these ETFs.

This would mark a significant milestone, potentially opening the door to substantial institutional investment in Ethereum.

The market is changing

The growing number of small Ethereum holders indicates a shift in market sentiment. Retail investors are increasingly seeing Ethereum as a valuable asset to hold, possibly due to its recent price performance and the perceived legitimacy that an ETF approval could bring.

This retail frenzy could have broader implications for the whole cryptocurrency market, potentially driving further price increases as demand outstrips supply.

The potential approval of Spot Ether ETFs could have far-reaching consequences.

Institutional investors, who have been largely cautious about direct cryptocurrency investments, may see an ETF as a safer and more regulated way to gain exposure to Ethereum.

This influx of institutional money could boost Ethereum’s price and adoption in a big way.

Ethereum: security or commodity?

Despite the positive developments, uncertainty remains. The SEC’s ongoing investigation into Ethereum’s classification as a security could influence the ETF approval process.

If Ethereum were classified as a security, it could face way stricter regulations, affecting its market dynamics and investor sentiment.

Therefore, while the request for updated ETF filings is a promising sign, the final decision is far from certain.

The recent spike in small Ethereum investors and the speculation around Spot Ether ETF approval highlight the unpredictable nature of the cryptocurrency market.

Growing retail interest suggests a broader acceptance and confidence in Ethereum, which could drive further investment and price appreciation.

Next to this, the market remains sensitive to regulatory developments, and the outcome of the SEC’s review will be a determining factor in the future of Ethereum.