The world of Bitcoin trading is experiencing a significant shift right now, with the US market taking center stage.

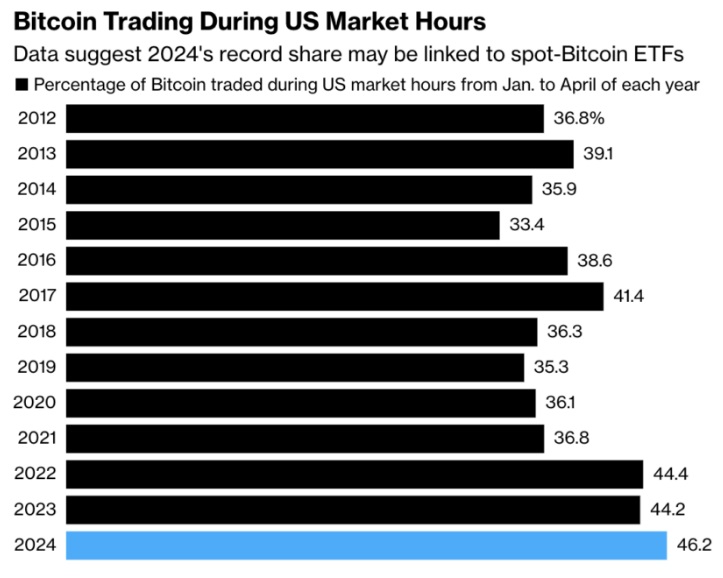

Recent data reveals a record-breaking surge in Bitcoin trading volume during US market hours in 2024.

US Market Hours Rule

This year 46% of all Bitcoin trading activity has occurred during US market hours, marking the highest share ever recorded, and many expert thinks this dramatic shift is likely linked to the highly anticipated launch of Spot Bitcoin ETFs in January this year.

These ETFs offer a regulated way for investors to gain exposure to Bitcoin’s price movement without directly owning the cryptocurrency itself.

Trading Patterns Reflect ETF Influence

The influence of ETFs is further evidenced by the changing trading patterns, the data shows significant spikes in Bitcoin trading volume at the open and close of US markets, which coincides with the timing of ETF calculations.

For the traders, Thursdays have emerged as the most popular day for US Bitcoin trading, accounting for nearly 15% of the weekly volume. This could be connected to weekly adjustments made by some ETF products.

Dominance and Volatility

The rise of US dominance in Bitcoin trading could have a two-sided impact.

On one hand, it suggests growing US investor interest in Bitcoin, potentially leading to a more mature and stable market, but this concentration could also make Bitcoin prices more susceptible to fluctuations during US trading hours.

Bitcoin ETFs and Volatility

Another interesting observation is the potential for reduced Bitcoin volatility with the advent of Spot Bitcoin ETFs.

Crypto experts theorize that these ETFs might contribute to a smoother price ride compared to Bitcoin’s historical volatility, due to factors like increased institutional participation and diversification of investment strategies.

While the exact reasons behind this potential decrease are still under debate, it could make Bitcoin a more attractive proposition for risk-averse investors.

Strong Start, Continued Interest

The success of Spot Bitcoin ETFs cannot be ignored, since their launch, these products have attracted nearly tens of billions of dollars in inflows, highlighting huge investor demand.

While this demand has slowed down recently, there are signs of a resurgence, indicating continued interest in this new way to invest in Bitcoin.

The Future of Bitcoin Trading

The US market dominance and the potential impact of Spot Bitcoin ETFs paint a picture of a rapidly evolving landscape for Bitcoin trading.

As this market matures, we will see whether the US maintains its lead and if ETFs truly contribute to a more stable Bitcoin ecosystem.