Nearly all private wealth investors in Asia are either already involved in or considering investments in cryptocurrency.

The growing interest is driven by the increasing potential of digital assets, especially Bitcoin.

The real crypto adoption

A new study by Aspen Digital reveals that 76% of Asia’s private wealth holders have already ventured into the world of digital assets, with another 18% planning to make future investments.

This is a quite sharp increase compared to 2022 when only 58% had any exposure to digital assets.

The report surveyed 80 family offices and wealthy individuals managing assets between $10 million and $500 million.

Most of the respondents who are already invested in crypto have allocated less than 5% of their portfolios to digital currencies, some have increased their investments to more than 10% by 2024.

This growing interest reflects a visible shift toward the profit potential of blockchain technology and digital assets.

Bitcoin and DeFi, the new opportunities

One of the key findings in the report is the undeniable optimism surrounding Bitcoin’s future.

Among the respondents, 31% predict that Bitcoin could hit $100,000 by the end of 2024, reflecting the strong belief in its long-term value.

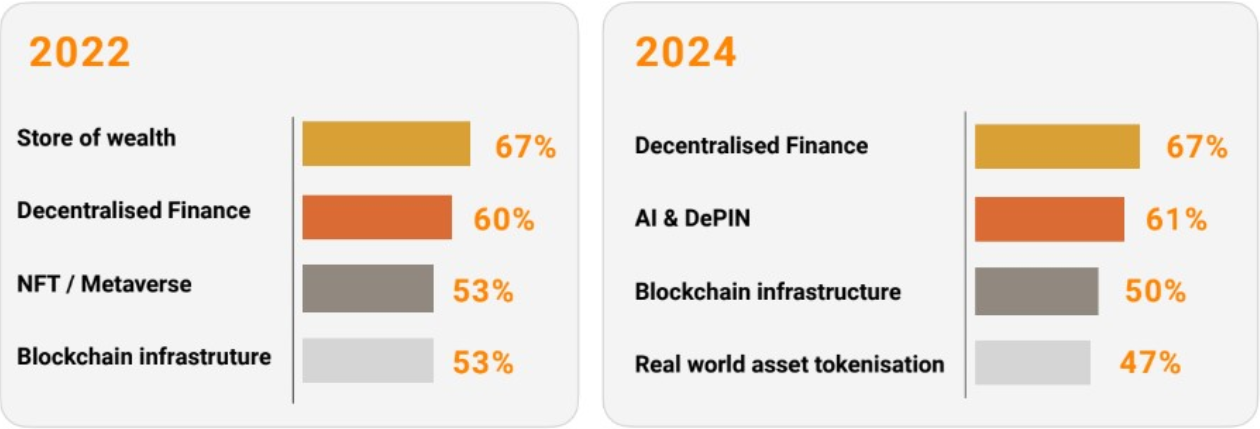

Investors are also increasingly drawn to decentralized finance opportunities, with two-thirds expressing interest in exploring this sector.

Another 61% have shown interest in other emerging technologies, such as artificial intelligence and decentralized physical infrastructure networks, the so-called DePIN technology, which could provide new investment avenues in the future.

This optimism is contributing to the increasing allocation of private wealth into digital assets, with many investors seeing blockchain’s potential to transform financial markets and industries.

Bitcoin ETFs in Asia

The report also highlights the growing role of ETFs in boosting crypto investments among Asian private wealth holders.

53% of respondents gained exposure to digital assets through funds or ETFs.

The launch of spot Bitcoin ETFs, particularly in the United States and Asia, played a key role in driving this trend.

The Global Crypto Hedge Fund Report from AIMA and PwC also reports a rise in crypto exposure among hedge funds globally.

Crypto investments in hedge funds surged from 29% in 2023 to 47% in 2024, with the approval of Bitcoin ETFs providing regulatory clarity and increasing interest in digital assets.

Spot Bitcoin ETFs began trading in the US in early 2024, and Hong Kong followed with the launch of spot Bitcoin and Ether ETFs in April.